Philips 2014 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244

|

|

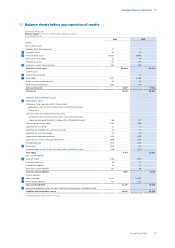

A B C D Company nancial statements 13.4

Annual Report 2014 179

13.4 Notes

Notes to the Company nancial statements

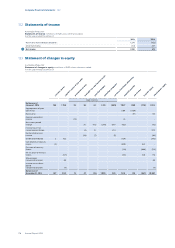

ANet income

Net income from affiliated companies represents the share

of the company in the results of these affiliated companies.

BAudit fees

For a summary of the audit fees, please refer to the

Group Financial statements, note 6, Income from

operations, which is deemed incorporated and

repeated herein by reference.

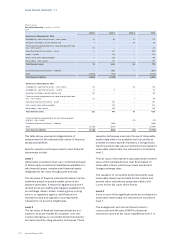

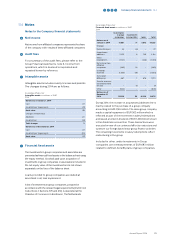

CIntangible assets

Intangible assets includes mainly licenses and patents.

The changes during 2014 are as follows;

Koninklijke Philips N.V.

Intangible assets in millions of EUR

2014

Balance as of January 1, 2014:

Cost 67

Amortization/ impairments (12)

Book value 55

Changes in book value:

Additions 20

Amortization (18)

Total changes 2

Balance as of December 31, 2014:

Cost 87

Amortization/ impairments (30)

Book value 57

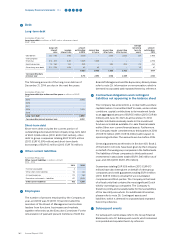

DFinancial xed assets

The investments in group companies and associates are

presented as financial fixed assets in the balance sheet using

the equity method. Goodwill paid upon acquisition of

investments in group companies or associates is included in

the net equity value of the investment and is not shown

separately on the face of the balance sheet.

Loans provided to group companies are stated at

amortized cost, less impairment.

A list of investments in group companies, prepared in

accordance with the relevant legal requirements (Dutch Civil

Code, Book 2, Sections 379 and 414), is deposited at the

Chamber of Commerce in Eindhoven, The Netherlands.

Koninklijke Philips N.V.

Financial xed assets in millions of EUR

2014

investments

in group

companies

investments

in associates loans total

Balance as of

January 1, 2014 13,591 71 5,873 19,535

Changes:

Reclassications 35 (8) – 27

Acquisitions/

additions 2,379 6 749 3,134

Sales/

redemptions (1,107) – (348) (1,455)

Net income from

aliated

companies (485) 16 – (469)

Dividends

received (1,836) (19) – (1,855)

Translation

dierences 687 7 676 1,370

Transfer to assets

classied as held

for sale – (7) – (7)

Other (604) – – (604)

Balance as of

December 31,

2014 12,660 66 6,950 19,676

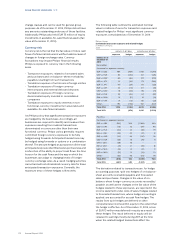

During 2014, the increase in acquisitions/additions line is

mainly related to the purchase of a group company

amounting to EUR 2,165 million. The same group company

made a capital repayment of EUR 562 million which is

reected as part of the movement in sales/redemptions

and issued an interim dividend of EUR 1,458 million shown

in the dividends received line. These transactions were

executed in view of our continued eort to restructure and

optimize our foreign based intra-group nance activities.

The remaining movements in sales/redemptions reect

restructuring in the group.

Included in other, under Investments in Group

companies, are remeasurements of EUR 683 million

related to dened-benet plans of group companies.