Philips 2014 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company nancial statements 13.4 H I J K L

182 Annual Report 2014

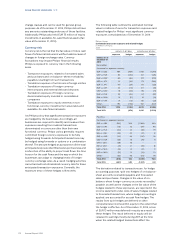

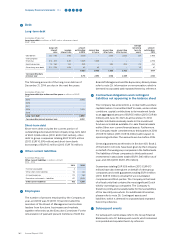

HDebt

Long-term debt

Koninklijke Philips N.V.

Long-term debt in millions of EUR, unless otherwise stated

2013 - 2014

(range of)

interest

rates

average

interest rate

amount

outstanding

in 2014

amount due

in 1 year

amount due

after 1 year

amount due

after 5 years

average

remaining

term (in

years)

amount

outstanding

2013

USD bonds 3.8 - 7.8% 5.6% 3,355 – 3,355 2,333 12.7 2,958

Intercompany

nancing 0.0 - 4.1% 0.8% 3,025 3,025 – – – 2,296

Bank borrowings 1.3 - 1.6% 1.5% 200 – 200 200 7.0 450

Other long-term debt 2.5 - 7.0% 4.5% 43 43 – – 1.0 47

6,623 3,068 3,555 2,533 5,751

Corresponding data

previous year 5,751 2,593 3,158 2,259 4,153

The following amounts of the long-term debt as of

December 31, 2014, are due in the next ve years:

Koninklijke Philips N.V.

Long-term debt due in the next ve years in millions of EUR

2014

2015 3,068

2016 –

2017 –

2018 1,022

2019

Long -term debt 4,090

Corresponding amount previous year 3,492

Short-term debt

Short-term debt includes the current portion of

outstanding external and intercompany long-term debt

of EUR 3,068 million (2013: EUR 2,593 million), other

debt to group companies totaling EUR 10,929 million

(2013: EUR 10,976 million) and short-term bank

borrowings of EUR 63 million (2013: EUR 76 million).

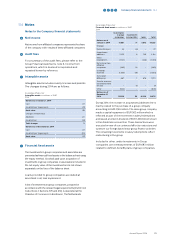

IOther current liabilities

Koninklijke Philips N.V.

Other current liabilities in millions of EUR

2013 - 2014

2013 2014

Income tax payable 4 –

Other short-term liabilities 53 63

Accrued expenses 174 138

Derivative instruments - liabilities 471 1,009

Other current liabilities 702 1,210

JEmployees

The number of persons employed by the Company at

year-end 2014 was 10 (2013: 10) and included the

members of the Board of Management and certain

leaders from functions, businesses and markets,

together referred to as the Executive Committee. For the

remuneration of past and present members of both the

Board of Management and the Supervisory Board, please

refer to note 29, Information on remuneration, which is

deemed incorporated and repeated herein by reference.

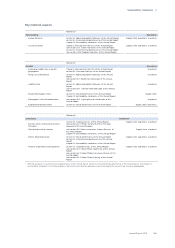

KContractual obligations and contingent

liabilities not appearing in the balance sheet

The Company has entered into a contract with a venture

capitalist where it committed itself to make, under certain

conditions, capital contributions to its investment funds

to an aggregated amount of EUR 35 million (2013: EUR 40

million) until June 30, 2021. As at December 31, 2014

capital contributions already made to this investment

fund are recorded as available-for-sale financial assets

within Other non-current financial assets. Furthermore,

the Company made commitments to third parties in 2014

of EUR 10 million (2013: EUR 16 million) with respect to

sponsoring activities. The amounts are due before 2016.

General guarantees as referred to in Section 403, Book 2,

of the Dutch Civil Code, have been given by the Company

on behalf of several group companies in the Netherlands.

The liabilities of these companies to third parties and

investments in associates totaled EUR 1,546 million as of

year-end 2014 (2013: EUR 1,255 million).

Guarantees totaling EUR 636 million (2013: EUR 613

million) have also been given on behalf of other group

companies and credit guarantees totaling EUR 4 million

(2013: EUR 15 million) on behalf of unconsolidated

companies and third-parties. The Company is the head

of a fiscal unity that contains the most significant Dutch

wholly-owned group companies. The Company is

therefore jointly and severally liable for the tax liabilities

of the tax entity as a whole. For additional information,

please refer to note 26, Contingent assets and

liabilities, which is deemed incorporated and repeated

herein by reference.

LSubsequent events

For subsequent events please refer to the Group Financial

Statements,

note 32, Subsequent events

, which is deemed

incorporated and repeated herein by reference.