Philips 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Supervisory Board report 10.2.4

Annual Report 2014 85

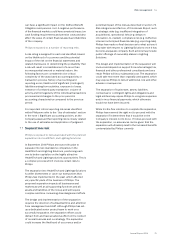

10.2.4 Remuneration costs

The table below gives an overview of the costs incurred

by the Company in the nancial year in relation to the

remuneration of the Board of Management. Costs

related to performance shares, stock option and

restricted share right grants are taken by the Company

over a number of years. As a consequence, the costs

mentioned below in the performance shares, stock

options and restricted share rights columns are the

accounting cost of multi-year grants given to members

of the Board of Management during their board

membership.

Philips Group

Remuneration Board of Management1) in EUR

2014

Costs in the year

annual

base

salary2)

base

salary

realized

annual

incentive

perfor-

mance

shares

stock

options

restricted

share

rights

pension

costs

other

compen-

sation

F.A. van Houten 1,150,000 1,137,500 349,600 860,564 101,344 76,951 485,655 86,554

R.H. Wirahadiraksa 725,000 712,500 156,600 446,337 68,914 52,965 298,995 35,909

P.A.J. Nota 650,000 643,750 258,180 406,358 68,914 57,200 267,037 63,507

2,493,750 764,380 1,713,259 239,172 187,116 1,051,687 185,970

1) Reference date for board membership is December 31, 2014

2) Salary as of April 1, 2014

10.2.5 Base salary

The base salaries of the members of the Board of

Management have been reviewed in April 2014 as part

of the regular remuneration review. The salary of Frans

van Houten has been increased per April 1, 2014, from

EUR 1,100,000 to EUR 1,150,000. The salary of the CFO,

Ron Wirahadiraksa, has been increased from EUR

675,000 to EUR 725,000. The salary of Pieter Nota has

been increased from EUR 625,000 to EUR 650,000. All

increases were made to move base salary levels closer

to market levels.

10.2.6 Annual Incentive

Each year, a variable cash incentive (Annual Incentive)

can be earned, based on the achievement of specic

and challenging targets. The Annual Incentive criteria

are made up for 80% of the nancial indicators of the

Company and for 20% of the team targets comprising,

among others, sustainability targets as part of our

EcoVision program.

The on-target Annual Incentive percentage is set at

80% of the base salary for the CEO and at 60% of the

base salary for other members of the Board of

Management. The maximum Annual Incentive

achievable is 160% of the annual base salary for the

CEO and 120% of the annual base salary for members

of the Board of Management.

To support the performance culture, the Annual

Incentive plan is based on (nancial) targets at ‘own

level’ and ‘group’ level results (line-of-sight). The 2014

payouts, shown in the table below, reect the below

target performance of EBITA, CSG and ROIC at the

Group level. In addition, the average Team Target

payout was also less than the target level.

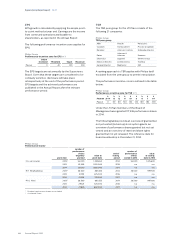

Philips Group

Annual Incentive realization in EUR

2014 (payout in 2015)

realized annual

incentive

as a % of base

salary (2014)

F.A. van Houten 349,600 30.4%

R.H. Wirahadiraksa 156,600 21.6%

P.A.J. Nota 258,180 39.7%

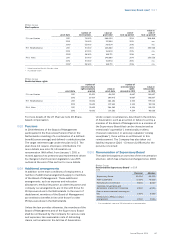

10.2.7 Long-Term Incentive Plan

Grants made under the 2014 LTI Plan consist of

performance shares only.

Grant size

The annual grant size is set by reference to a multiple

of base salary. For the CEO the annual grant size is set

at 120% of base salary and for the other members of the

Board of Management at 100% of base salary. This is

broadly at a mid-market level against leading European

listed companies. The actual number of performance

shares to be awarded is determined by reference to the

average of the closing price of the Philips share on the

day of publication of the quarterly results and the four

subsequent dealing days.

Vesting schedule

Dependent upon the achievement of the performance

conditions, cli-vesting applies three years after the

date of grant. During the vesting period, the value of

dividends will be added to the performance shares in

the form of shares. These dividend-equivalent shares

will only be delivered to the extent that the award

actually vests.

Performance conditions

Vesting of the performance shares is based on two

equally weighted performance conditions:

▪50% Adjusted Earnings per Share growth (“EPS”) and

▪50% Relative Total Shareholder Return (“TSR”)