Philips 2014 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group performance 5.1

22 Annual Report 2014

due to Healthcare and Lighting. Healthcare comparable

sales declined by 2%, mainly due to Imaging Systems.

Lighting comparable sales were 3% below the level of

2013, as declines at Light Sources & Electronics and

Consumer Luminaires were tempered by growth at

Professional Lighting Solutions. Comparable sales at

Consumer Lifestyle were 6% above the level of 2013,

mainly driven by double-digit growth at Health & Wellness.

•

Comparable sales in growth geographies were in line with

2013, while mature geographies declined by 1% as a result

of the overall macroeconomic developments. In 2014,

growth geographies accounted for 35% of total sales.

•

EBIT amounted to EUR 486 million, or 2.3% of sales,

compared to EUR 1,855 million, or 8.4% of sales, in 2013.

EBIT declines at Healthcare, Lighting and IG&S were partly

offset by an improvement at Consumer Lifestyle.

•

Operating activities generated cash flows of EUR 1,303

million, which was EUR 391 million higher than in 2013. The

increase was mainly due to higher cash inflows and

working capital reductions in 2014, as well as the payment

of the European Commission fine in 2013. Cash flows

before financing activities were EUR 269 million higher

than in 2013, as an increase in cash flows from operating

activities was partly offset by higher outflows related to

acquisitions of new businesses.

•

By the end of 2014, Philips had completed 41% of the EUR

1.5 billion share buy-back program.

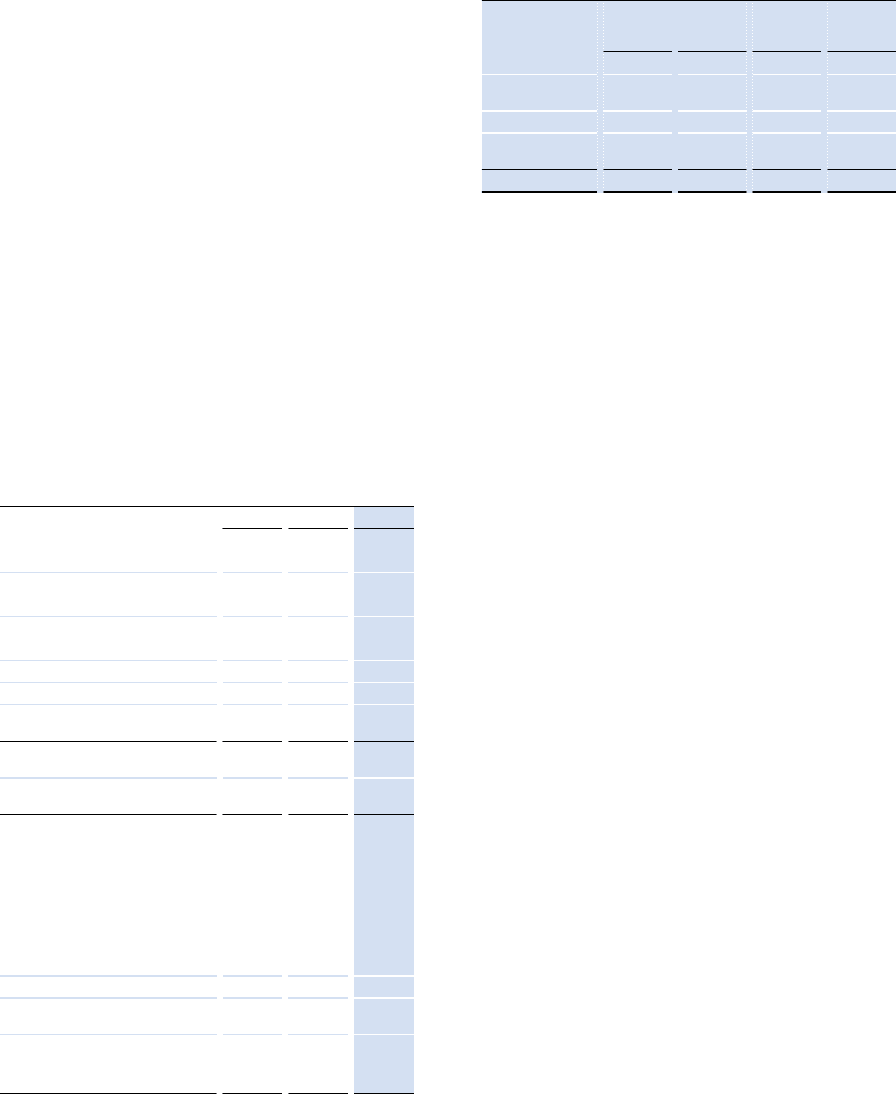

Philips Group

Key data in millions of EUR unless otherwise stated

2012 - 2014

2012 2013 2014

Condensed statement of income

Sales 22,234 21,990 21,391

EBITA 1) 1,003 2,276 821

as a % of sales 4.5% 10.4% 3.8%

EBIT 592 1,855 486

as a % of sales 2.7% 8.4% 2.3%

Financial income and expenses (329) (330) (301)

Income tax expense (218) (466) (26)

Results of investments in

associates (211) (25) 62

Income (loss) from continuing

operations (166) 1,034 221

Income from discontinued

operations - net of income tax 136 138 190

Net income (loss) (30) 1,172 411

Other indicators

Net income (loss) attributable to

shareholders per common share

in EUR:

basic (0.04) 1.28 0.45

diluted (0.04) 1.27 0.45

Net operating capital (NOC)1) 9,316 10,238 8,838

Cash ows before nancing

activities1) 1,174 50 319

Employees (FTEs) 118,087 116,082 113,678

of which discontinued

operations 10,631 10,445 8,313

1) For a reconciliation to the most directly comparable GAAP measures,

see chapter 15, Reconciliation of non-GAAP information, of this Annual

Report

5.1.1 Sales

The composition of sales growth in percentage terms in

2014, compared to 2013, is presented in the table below.

Philips Group

Sales growth composition in %

2014 versus 2013

com-

parable

growth

currency

eects

consoli-

dation

changes

nominal

growth

Healthcare (2.0) (1.6) (0.5) (4.1)

Consumer

Lifestyle 5.8 (3.1) 0.0 2.7

Lighting (2.6) (2.3) 1.0 (3.9)

Innovation, Group

& Services (11.8) (0.1) 2.9 (9.0)

Philips Group (0.9) (2.0) 0.2 (2.7)

Group sales amounted to EUR 21,391 million in 2014,

which represents a 3% nominal decline compared to

2013.

Adjusted for a 2% negative currency eect, comparable

sales were 1% below the level of 2013. Comparable sales

were up 6% at Consumer Lifestyle. Healthcare and

Lighting saw comparable sales decline by 2% and 3%

respectively.

Healthcare sales amounted to EUR 9,186 million, which

was EUR 389 million lower than in 2013. Mid-single-

digit growth at Customer Services and low-single-digit

growth at Patient Care & Monitoring Solutions were

oset by a double-digit decline at Imaging Systems.

Healthcare Informatics, Solutions & Services sales were

in line with 2013. Mature geographies recorded a low-

single-digit decline, mainly due to North America and

Western Europe. Growth geographies also recorded a

low-single-digit decline, with solid growth in Latin

America and Middle East & Turkey oset by a double-

digit decline in China.

Consumer Lifestyle reported sales of EUR 4,731 million,

which was EUR 126 million higher than in 2013, or 6%

higher on a comparable basis. Health & Wellness

achieved double-digit growth and Domestic

Appliances high-single-digit growth, while Personal

Care recorded low-single-digit growth. Growth

geographies achieved high-single-digit growth, driven

by strong growth in China, India and Middle East &

Turkey. Mature geographies recorded low-single-digit

growth, with mid-single-digit growth in Western Europe

and other mature geographies and low-single-digit

growth in North America.

Lighting sales amounted to EUR 6,869 million, which

was EUR 276 million lower than in 2013, or 3% lower on

a comparable basis. A high-single-digit decline at

Consumer Luminaires and mid-single-digit decline at

Light Sources & Electronics were tempered by low-

single-digit growth at Professional Lighting Solutions. A

low-single-digit decline was seen in mature