Philips 2014 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group performance 5.1.5

Annual Report 2014 25

5.1.5 Pensions

In 2014, the total costs of post-employment benets

amounted to EUR 241 million for dened-benet plans

and EUR 144 million for dened-contribution plans,

compared to EUR 291 million and EUR 134 million

respectively in 2013.

The above costs are reported in Operating expenses

except for the net interest cost component which is

reported in Financial income and expense. The net

interest cost for dened-benet plans was EUR 59

million in 2014 (2013: EUR 71 million).

2014 included past-service cost gains in the

Netherlands of EUR 67 million, which were mainly

related to the mandatory plan change in the

Netherlands, where a salary cap of EUR 100,000 must

be applied to the pension salary with eect from

January 1, 2015. This change lowers the Company’s

Dened Benet Obligation which is recognized as a

past-service cost gain. Compensatory measures are

given in wages for employees impacted.

2013 included past-service cost gains of EUR 81 million,

which included EUR 78 million related to the

announced freeze of accrual after December 31, 2015

for salaried workers in the Company’s US dened-

benet pension plan. In the same US plan a settlement

loss of EUR 31 million was recognized in 2013 following

a lump-sum oering to terminated vested employees.

This oering resulted in settling the pension obligations

towards these employees. The past-service cost gain is

allocated to the respective sectors of the US employees

involved, whereas the settlement loss is allocated fully

to Pensions in IG&S as it related to inactive employees.

The overall funded status of our dened-benet

pension plans in 2014 decreased compared to 2013 due

to a decrease in discount rates used to measure the

dened benet obligation. The decits recognized on

our balance sheet increased by approximately EUR 393

million due to lower discount rates in the US and

Germany and a new adopted mortality table in the US.

In 2014, further progress was made in managing the

nancial exposure to dened-benet plans by two

further buy-ins in the UK plan.

For further information, refer to Post-employment

benets.

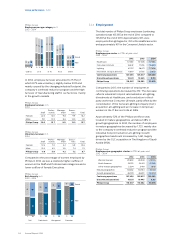

5.1.6 Restructuring and impairment charges

In 2014, EBIT included net charges totaling EUR 414

million for restructuring. In addition to the annual

goodwill-impairment tests for Philips, trigger-based

impairment tests were performed during the year,

resulting in a goodwill impairment of EUR 1 million at

Healthcare and EUR 2 million at Lighting.

2013 included EUR 84 million of restructuring charges

and a goodwill impairment of EUR 26 million at

Consumer Luminaires, mainly as a consequence of

reduced growth rates resulting from a slower-than-

anticipated recovery of certain markets, as well as

delays in the introduction of new product ranges.

For further information on sensitivity analysis, please

refer to note 11, Goodwill.

In 2014, the most signicant restructuring projects

related to Lighting and IG&S and were driven by

industrial footprint rationalization and the Accelerate!

transformation program. Restructuring projects at

Lighting centered on Light Sources & Electronics and

Professional Lighting Solutions, the largest of which

took place in the Belgium, Netherlands and France.

Innovation, Group & Services restructuring projects

mainly were related to IT and group and country

overheads and centered primarily on the Netherlands,

US and Belgium. Restructuring projects at Healthcare

mainly took place in the US and the Netherlands.

Consumer Lifestyle restructuring projects were mainly

in the Netherlands.

In 2013, the more signicant restructuring projects were

related to industrial footprint rationalization at Lighting.

The largest projects were centered at Consumer

Luminaires and Light Sources & Electronics, mainly in

the Unites States, France and Belgium. Innovation

Group & Services restructuring projects were largely

focused on the Financial Operations Service Units,

primarily in Italy, France and the United States.

Restructuring projects at Consumer Lifestyle were

mainly seen at Personal Care in the Netherlands and

Austria and Coee in Italy.

For further information on restructuring, refer to note 19,

Provisions.

Philips Group

Restructuring and related charges in millions of EUR

2012 - 2014

2012 2013 2014

Restructuring and related charges per

sector:

Healthcare 116 (6) 68

Consumer Lifestyle 38 10 8

Lighting 294 77 225

Innovation, Group & Services 56 3 113

Continuing operations 504 84 414

Discontinued operations 36 33 18

Cost breakdown of restructuring and

related charges:

Personnel lay-o costs 414 95 354

Release of provision (33) (62) (36)

Restructuring-related asset

impairment 66 25 57

Other restructuring-related costs 57 26 39

Continuing operations 504 84 414

Discontinued operations 36 33 18