Philips 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group performance 5.1.18

30 Annual Report 2014

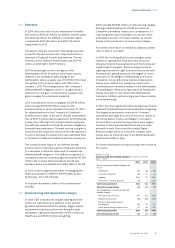

5.1.18 Cash and cash equivalents

In 2014, cash and cash equivalents decreased by EUR

592 million to EUR 1,873 million at year-end. The

decrease was mainly attributable to an outow on cash

outows for treasury share transactions of EUR 596

million, cash dividend payout of EUR 292 million, EUR

301 million from decreases in debt and a EUR 258

million outow related to acquisitions. This was partly

oset by a EUR 497 million free cash ow.

Philips Group

Cash balance movements in millions of EUR

2014

2,4652013

+87Divestments

+4971)

Free cash flow

+782)

Other

-301Debt

-258Acquisitions

-596Treasury share transaction

-292Dividend

+193Discontinued operations

1,8732014

-592

1) Please refer to chapter 15, Reconciliation of non-GAAP information, of

this Annual Report

2) Includes cash ow for derivatives and currency eect

5.1.19 Debt position

Total debt outstanding at the end of 2014 was EUR 4,104

million, compared with EUR 3,901 million at the end of

2013.

Philips Group

Changes in debt in millions of EUR

2012 - 2014

2012 2013 2014

New borrowings (1,361) (64) (69)

Repayments 631 471 370

Currency eects and consolidation

changes 56 226 (504)

Changes in debt (674) 633 (203)

In 2014, total debt increased by EUR 203 million. New

borrowings of EUR 69 million consisted mainly of

replacements to lease contracts. Repayment of EUR

370 million included a EUR 250 million repayment of a

ve year loan. Other changes resulting from

consolidation and currency eects led to an increase of

EUR 504 million.

In 2013, total debt decreased by EUR 633 million. New

borrowings of EUR 64 million consisted mainly of

replacements to lease contracts. Repayment of EUR 471

million included a USD 143 million redemption on USD

bonds as well as payments on short-term debt. Other

changes resulting from consolidation and

currency eects led to a decrease of EUR 226 million.

Long-term debt as a proportion of the total debt stood

at 90% at the end of 2014 with an average remaining

term of 11.6 years, compared to 85% and 12.8 years at

the end of 2013.

For further information, please refer to note 18, Debt.

5.1.20 Shareholders’ equity

Shareholders’ equity decreased by EUR 347 million in

2014 to EUR 10,867 million at December 31, 2014. The

decrease was mainly a result of EUR 714 million related

to purchase shares for the share buy-back program and

coverage for the LTI program, partially oset by EUR 415

million net income and EUR 50 million of other

comprehensive income. The dividend payment to

shareholders in 2014 reduced equity by EUR 293 million

including tax and service charges, while the delivery of

treasury shares increased equity by EUR 116 million and

share-based compensation plans increased equity by

EUR 88 million.

The number of outstanding common shares of Royal

Philips at December 31, 2014 was 914 million (2013: 913

million). At the end of 2014, the Company held 17.1

million shares in treasury to cover the future delivery of

shares (2013: 20.7 million shares). This was in

connection with the 40.8 million rights outstanding at

the end of 2014 (2013: 44.3 million rights) under the

Company’s long-term incentive plans. At the end of

2014, the Company held 3.3 million shares for

cancellation (2013: 3.9 million shares).

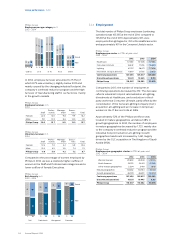

5.1.21 Net debt to group equity

Philips ended 2014 in a net debt position (total debt less

cash and cash equivalents) of EUR 2,231 million,

compared to a net debt position of EUR 1,436 million at

the end of 2013.

Philips Group

Net debt (cash) to group equity1) in billions of EUR

2010 - 2014

(1.2)

15.1

‘10

(8) : 108

0.7

12.4

‘11

5 : 95

0.7

11.2

‘12

6 : 94

1.4

11.2

‘13

11 : 89

2.2 Net debt (cash)

11.0 Group equity2)

‘14

17 : 83 ratio

1) For a reconciliation to the most directly comparable GAAP measures,

see chapter 15, Reconciliation of non-GAAP information, of this Annual

Report

2) Shareholders’ equity and non-controlling interests