Philips 2014 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

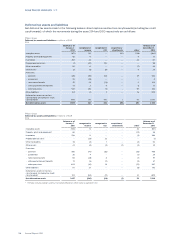

Group nancial statements 12.9

138 Annual Report 2014

Classication of the income tax payable and receivable

is as follows:

Philips Group

Income tax payable and receivable in millions of EUR

2013 - 2014

2013 2014

Income tax receivable 70 140

Income tax receivable - under non-current

receivables – –

Income tax payable (143) (102)

Income tax payable - under non-current

liabilities (1) (1)

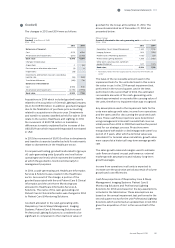

Tax risks

Philips is exposed to tax uncertainties. These

uncertainties include amongst others the following:

Transfer pricing uncertainties

Philips has issued transfer pricing directives, which are

in accordance with international guidelines such as

those of the Organization of Economic Co-operation

and Development. As transfer pricing has a cross-

border eect, the focus of local tax authorities on

implemented transfer pricing procedures in a country

may have an impact on results in another country. In

order to reduce the transfer pricing uncertainties,

monitoring procedures are carried out by Group Tax

and Internal Audit to safeguard the correct

implementation of the transfer pricing directives.

Tax uncertainties on general and specic

service agreements and licensing agreements

Due to the centralization of certain activities in a limited

number of countries (such as research and

development, centralized IT, group functions and head

oce), costs are also centralized. As a consequence,

these costs and/or revenues must be allocated to the

beneciaries, i.e. the various Philips entities. For that

purpose, specic allocation contracts for costs and

revenues, general service agreements and licensing

agreements are signed with a large number of group

entities. Tax authorities review the implementation of

these intra-group service and licensing agreements or

audit the use of tax credits attached to the resulting

service fee and royalty payments, and may reject the

implemented procedures. Furthermore, buy in/out

situations in the case of (de)mergers could aect the

cost allocation resulting from the service agreements

between countries. The same applies to the specic

allocation contracts.

Tax uncertainties due to disentanglements and

acquisitions

When a subsidiary of Philips is disentangled, or a new

company is acquired, related tax uncertainties arise.

Philips creates merger and acquisition (M&A) teams for

these disentanglements or acquisitions. In addition to

representatives from the involved sector, these teams

consist of specialists from various group functions and

are formed, amongst other things, to identify hidden tax

uncertainties that could subsequently surface when

companies are acquired and to reduce tax claims

related to disentangled entities. These tax uncertainties

are investigated and assessed to mitigate tax

uncertainties in the future of the extent possible.

Several tax uncertainties may surface from M&A

activities. Examples of uncertainties are: applicability of

the participation exemption, allocation issues, and

non-deductibility of parts of the purchase price.

Tax uncertainties due to permanent

establishments

In countries where Philips starts new operations or

alters business models, the issue of permanent

establishment may arise. This is because when

operations in a country involves a Philips organization

in another country, there is a risk that tax claims will

arise in the former country as well as in the latter

country.