Philips 2014 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 Group nancial statements 12.9

Annual Report 2014 175

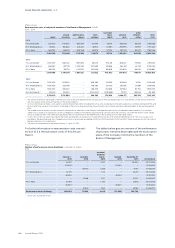

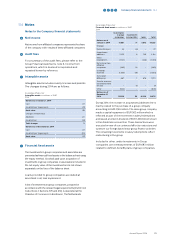

Below table shows the credit ratings of the nancial

institutions with which Philips had short-term deposits

above EUR 25 million as of December 31, 2014:

Philips Group

Credit risk with number of counterparties

for deposits above EUR 25 million

2014

25-100 million

100-500

million

500-2,000

million

AA-rated

governments – – –

AA-rated

government

banks – – –

AAA-rated bank

counterparties – – –

AA-rated bank

counterparties 2 1 –

A-rated bank

counterparties 7 3 –

9 4 –

For an overview of the overall maximum credit

exposure of the group’s nancial assets, please refer to

note 30, Fair value of nancial assets and liabilities for

details of carrying amounts and fair value.

Country risk

Country risk is the risk that political, legal, or economic

developments in a single country could adversely

impact our performance. The country risk per country is

dened as the sum of the equity of all subsidiaries and

associated companies in country cross-border

transactions, such as intercompany loans, accounts

receivable from third parties and intercompany

accounts receivable. The country risk is monitored on a

regular basis.

As of December 31, 2014, the Company had country risk

exposure of EUR 8.5 billion in the United States, EUR

2.6 billion in Belgium and EUR 1.8 billion in China

(including Hong Kong). Other countries higher than EUR

500 million are United Kingdom (EUR 709 million) and

Japan (EUR 576 million). Countries where the risk

exceeded EUR 300 million but was less than EUR 500

million are Germany, Malaysia, Poland and Saudi

Arabia. The degree of risk of a country is taken into

account when new investments are considered. The

Company does not, however, use nancial derivative

instruments to hedge country risk.

Other insurable risks

Philips is covered for a broad range of losses by global

insurance policies in the areas of property damage/

business interruption, general and product liability,

transport, directors’ and ocers’ liability, employment

practice liability, crime, and aviation product liability.

The counterparty risk related to the insurance

companies participating in the above mentioned global

insurance policies are actively managed. As a rule

Philips only selects insurance companies with a S&P

credit rating of at least A-. Throughout the year the

counterparty risk is monitored on a regular basis.

To lower exposures and to avoid potential losses,

Philips has a global Risk Engineering program in place.

The main focus of this program is on property damage

and business interruption risks including company

interdependencies. Regular on-site assessments take

place at Philips locations and business critical suppliers

by risk engineers of the insurer in order to provide an

accurate assessment of the potential loss and its

impact. The results of these assessments are shared

across the Company’s stakeholders. On-site

assessments are carried out against the predened Risk

Engineering standards which are agreed between

Philips and the insurers. Recommendations are made

in a Risk Improvement report and are monitored

centrally. This is the basis for decision-making by the

local management of the business as to which

recommendations will be implemented.

For all policies, deductibles are in place, which vary

from EUR 250,000 to EUR 2,500,000 per occurrence

and this variance is designed to dierentiate between

the existing risk categories within Philips. Above this

rst layer of working deductibles, Philips operates its

own re-insurance captive, which during 2014 retained

EUR 2.5 million per occurrence for property damage

and business interruption losses and EUR 5 million in

the aggregate per year. For general and product liability

claims, the captive retained EUR 1.5 million per claim

and EUR 6 million in the aggregate. New contracts were

signed on December 31, 2014, for the coming year,

whereby the re-insurance captive retentions remained

unchanged.

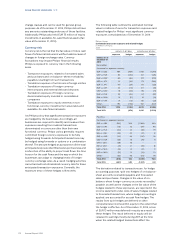

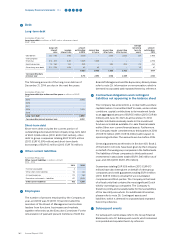

32 Subsequent events

Acquisition of Volcano

On December 17, 2014, Philips and Volcano Corporation

(Volcano) announced that they had entered into a

denitive merger agreement. Volcano is a US-based

global leader in catheter based imaging and

measurement solutions for cardio vascular applications

and is very complementary to the Philips vision,

strategy, and portfolio in image-guided therapy. On

February 17, 2015, Philips completed a tender oer to

acquire all of the issued and outstanding shares of

Volcano for USD 18.00 per share. The total equity

purchase price and the settlement of stock option rights

involved an amount of USD 955 million (approximately

EUR 840 million) and was paid in cash at closing date.

Philips is nancing the acquisition through a

combination of cash on hand and the issuance of debt.

Philips will consolidate 100% of Volcano as of February

17, 2015. Due to the recent closing date, additional IFRS

disclosures cannot be made until the initial accounting

for the business combination has been completed.