Philips 2014 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group nancial statements 12.9

Annual Report 2014 147

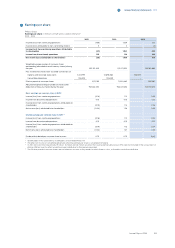

In order to reduce share capital, the following

transactions took place:

Philips Group

Share capital transactions

2013 - 2014

2013 2014

Shares acquired 27,807,372 21,283,315

Average market price EUR 22.69 EUR 23.95

Amount paid EUR 631 million EUR 510 million

Reduction of capital

stock (shares) 37,778,510 21,837,910

Reduction of capital

stock (EUR) EUR 787 million EUR 533 million

Total shares in treasury

at year-end 3,857,595 3,303,000

Total cost EUR 100 million EUR 77 million

Stock purchase transactions related to employee

option and share plans, as well as transactions related

to the reduction of share capital involved a cash outow

of EUR 712 million, which includes the impact of taxes.

Settlements of stock based compensation plans

involved a cash inow of EUR 116 million.

Dividend distribution

A proposal will be submitted to the 2015 Annual

General Meeting of Shareholders to pay a dividend of

EUR 0.80 per common share, in cash or shares at the

option of the shareholder, from the 2014 net income

and retained earnings of the Company.

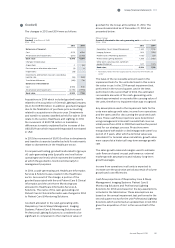

Limitations in the distribution of shareholders’

equity

As at December 31, 2014, pursuant to Dutch law, certain

limitations exist relating to the distribution of

shareholders’ equity of EUR 1,515 million. Such

limitations relate to common shares of EUR 187 million,

as well as to legal reserves required by Dutch law

included under retained earnings of EUR 1,059 million,

revaluation reserves of EUR 13 million, available-for-

sale nancial assets EUR 27 million and unrealized

currency translation dierences of EUR 229 million. The

unrealized losses related to cash ow hedges of EUR 13

million, although qualifying as a legal reserve, reduce

the distributable amount by their nature.

As at December 31, 2013, these limitations in

distributable amounts were EUR 1,609 million and

related to common shares of EUR 188 million, as well as

to legal reserves required by Dutch law included under

retained earnings of EUR 1,319 million, revaluation

reserves of EUR 23 million, available-for-sale nancial

assets of EUR 55 million and cash ow hedges EUR 24

million. The unrealized losses related to currency

translation dierences of EUR 569 million, although

qualifying as a legal reserve, reduce the distributable

amount by their nature.

The legal reserve required by Dutch law of EUR 1,059

million included under retained earnings relates to any

legal or economic restrictions on the ability of aliated

companies to transfer funds to the parent company in

the form of dividends.

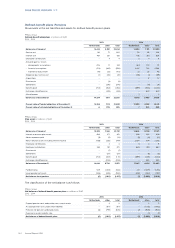

Non-controlling interests

Non-controlling interests relate to minority stakes held

by third parties in consolidated group companies. The

Net loss attributable to non-controlling interests

amounted to EUR 4 million in 2014 (Net income

attributable to non-controlling interests 2013: EUR 3

million).

In 2014 Philips increased its non-controlling interest

mainly due to the acquisition of General Lighting

Company, in which Alliance Holding domiciled in

Kingdom of Saudi Arabia holds an ownership

percentage of 49% (please refer to note 4, Acquisitions

and divestments).

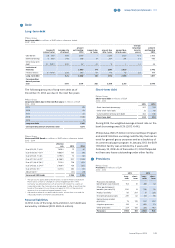

Objectives, policies and processes for

managing capital

Philips manages capital based upon the measures net

operating capital (NOC), net debt and cash ows before

nancing activities.

The Company believes that an understanding of the

Philips Group’s nancial condition is enhanced by the

disclosure of net operating capital (NOC), as this gure

is used by Philips’ management to evaluate the capital

eciency of the Philips Group and its operating sectors.

NOC is dened as: total assets excluding assets

classied as held for sale less: (a) cash and cash

equivalents, (b) deferred tax assets, (c) other non-

current nancial assets and current nancial assets, (d)

investments in associates, and after deduction of: (e)

provisions (f) accounts and notes payable, (g) accrued

liabilities, (h) other non-current liabilities and other

current liabilities.

Net debt is dened as the sum of long- and short-term

debt minus cash and cash equivalents. The net debt

position as a percentage of the sum of group equity

(shareholders’ equity and non-controlling interests)

and net debt is presented to express the nancial

strength of the Company. This measure is widely used

by management and investment analysts and is

therefore included in the disclosure. Our net debt

position is managed in such a way that we expect to

continuously meet our objective to retain our target at

A3 rating with stable outlook (Moody’s,) and A-rating

with negative outlook (Standard and Poor’s).

Furthermore, the Group’s objective when managing the

net debt position is to fulll our commitment to a stable

dividend policy with a 40% to 50% target pay-out from

continuing net income.