Philips 2014 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company nancial statements 13.5

Annual Report 2014 185

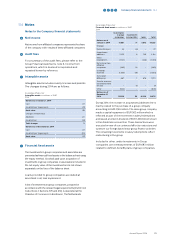

assessment process and signicant judgments and

assumptions involved which are aected by expected

future market or economic conditions. At December 31,

2014, the goodwill amounted to EUR 7.2 billion.

Our audit procedures included, amongst others, the

involvement of a valuation expert to assist us in

evaluating the assumptions and methodologies used

by the Company, in particular those relating to the

compound sales growth rate and pre-tax discount rate.

The cash ow projections, mainly for Healthcare cash-

generating units – Respiratory Care & Sleep

Management, Imaging Systems, and Patient Care &

Monitoring Solutions and Lighting cash-generating

units - Professional Lighting Solutions and Consumer

Luminaires have been assessed and challenged by us,

and includes an assessment of the historical accuracy

of management’s estimates and evaluation of business

plans. Based on the impairment test, it was noted that

with regard to the headroom for cash-generating unit

Consumer Luminaires, the estimated recoverable

amount approximates the carrying value of the cash-

generating unit. We also assessed the adequacy of the

disclosures in Section 12.9, Note 11 Goodwill relating to

those assumptions to which the outcome of the

impairment test is most sensitive, that is, those that

have the most signicant eect on the determination of

the recoverable amount of goodwill.

Accounting for income tax positions

Income tax was significant to our audit because the

assessment process is complex and the amounts involved

are material to the financial statements as a whole. The

Company has extensive international operations and in the

normal course of business makes judgments and estimates

in relation to tax issues and exposures resulting in the

recognition of other tax liabilities. At December 31, 2014, the

net deferred tax assets are valued at EUR 2.4 billion and the

other tax liability related to tax uncertainties is valued at EUR

499 million.

We have tested the completeness and accuracy of the

amounts reported for current and deferred tax including

the assessment of disputes with tax authorities. In this

area our audit procedures included, amongst others,

assessment of correspondence with the relevant tax

authorities, testing the effectiveness of the Company’s

internal controls around the recording and continuous re-

assessment of the other tax liabilities, and the

involvement of our local component auditors including

tax specialists in those components determined to be the

regions with significant tax risk. In respect of deferred tax

assets, we tested management’s assumptions used to

determine the probability that deferred tax assets

recognized in the balance sheet will be recovered through

taxable income in the countries where the deferred tax

assets originated and during the periods when the

deferred tax assets become deductible. During our

procedures, we used amongst others budgets, forecasts

and tax laws and in addition we assessed the historical

accuracy of management’s assumptions. We also

assessed the adequacy of the Company’s disclosure

included in Section 12.9, Note 8 Income taxes in respect

of income tax positions and uncertain tax positions.

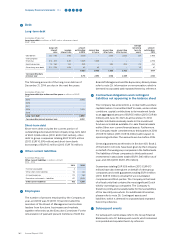

Revenue recognition

Sales contracts for certain projects in the Healthcare

and Lighting sectors typically involve multi-element

contracts, for example a single sales transaction that

combines the delivery of goods and rendering of

services, and involve separately identiable

components that are recognized based on relative fair

value. This gives rise to the risk that sales could be

misstated due to the complexity of the multi-element

contracts and the incorrect valuation of the relative fair

value elements. Sales in the remaining sectors are

generally recognized when the risks and rewards of the

underlying products have been transferred to the

customer and tend not to have multiple deliverable

elements. There is a risk that sales may be deliberately

overstated as a result of management override resulting

from the pressure management may feel to achieve

planned results. The management of the Group focuses

on sales as a key performance measure which could

create an incentive for sales to be recognized before

the risks and rewards have been transferred.

Our audit procedures included, amongst others,

assessing the appropriateness of the Company’s

revenue recognition accounting policies including

those relating to multi-element contracts and assess

compliance with the policies in terms of EU-IFRS. We

tested the eectiveness of the Company’s controls over

calculation of rebates, fair value determination of

multi-element sales contracts, and the correct timing of

revenue recognition. We also assessed sales

transactions taking place before and after year-end to

ensure that revenue was recognized in the correct

period and assessed the accuracy of the sales

recorded, based amongst others on inspection of sales

contracts, hand over certicates and hours reported

after recognition of revenue. We have assessed the

appropriateness of management’s response to

indications of improper revenue recognition and

performed additional work where considered

necessary. We also assessed the adequacy of the sales

disclosures contained in Section 12.9, Note 2

Information by sector and main country and Note 6

Income from operations.

Contingent liabilities and provisions from claims,

proceedings and investigations

The Company and certain of its group companies and

former group companies are involved as a party in legal

proceedings, including regulatory and other

governmental proceedings as well as investigations by

authorities. Since the ultimate disposition of asserted

claims and proceedings and investigations cannot be

predicted with certainty, an adverse outcome could

have a material adverse eect on the nancial position,

results of operations and cashows, resulting in the

identication of a signicant nancial statement risk.