RBS 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199

|

|

53

RBS – Interim Results 2015

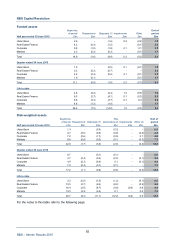

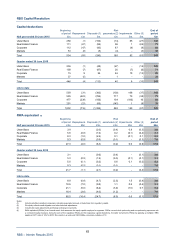

Corporate & Institutional Banking

Key points (continued)

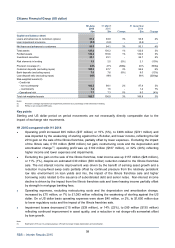

Q2 2015 compared with Q2 2014 (continued)

● The reduction in total income of £556 million was driven by CIB Capital Resolution, where: Markets

income fell from £282 million in Q2 2014 to £21 million in Q2 2015 (primarily due to the wind down o

f

US asset-backed products); Portfolio income was at £85 million in both periods; Transaction Services

income fell from £145 million in Q2 2014 to £104 million in Q2 2015; disposal losses of £113 million

were incurred in Q2 2015 (nil in Q2 2014). In CIB Go-forward lower Credit income was driven by the

market-wide reduction in EMEA debt capital market issuance compared to the same period last year.

● Operating expenses increased by £695 million to £1,841 million and included a £582 million increase

in restructuring costs and a £323 million increase in litigation and conduct costs. Adjusted expenses

fell by 22% reflecting the ongoing drive to reduce costs and simplify the business.

Note:

(1) The business transfer from CIB to CPB was effective from 1 May 2015. Comparatives were not restated and for the whole period the financials of the UK large corporate

business were: total income of £32 million in H1 2015 (H1 2014 - £31 million; Q2 2015 - £19 million; Q1 2015 - £15 million; Q2 2014 - £16 million); operating expenses o

f

£2 million in H1 2015 (H1 2014 - £4 million; Q2 2015 - £1 million; Q1 2015 - £1 million; Q2 2014 - £2 million); net loans and advances to customers of £2.1 billion (31

March 2015 - £2.0 billion; 31 December 2014 - £1.8 billion); and RWAs of £2.3 billion (31 March 2015 - £2.1 billion; 31 December 2014 - £2.1 billion).