Regions Bank 2012 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2012 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.REVENUE RECOGNITION

The largest source of revenue for Regions is interest income. Interest income is recognized on an accrual

basis driven by nondiscretionary formulas based on written contracts, such as loan agreements or securities

contracts. Credit-related fees, including letter of credit fees, finance charges and fees related to credit cards are

recognized in non-interest income when earned. Regions recognizes commission revenue and exchange and

clearance fees on a trade-date basis. Other types of non-interest revenues, such as service charges on deposits,

interchange income on credit cards and trust revenues, are accrued and recognized into income as services are

provided and the amount of fees earned are reasonably determinable.

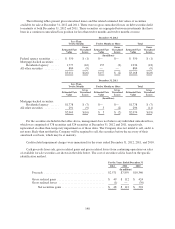

PER SHARE AMOUNTS

Earnings (loss) per common share computations are based upon the weighted-average number of shares

outstanding during the period. Diluted earnings (loss) per common share computations are based upon the

weighted-average number of shares outstanding during the period, plus the effect of outstanding stock options

and stock performance awards if dilutive. In prior years, the diluted earnings (loss) per common share

computation also assumes conversion of any outstanding convertible preferred stock and warrants, unless such an

assumed conversion would be antidilutive. Refer to Note 15 for additional information.

FAIR VALUE MEASUREMENTS

Fair value guidance establishes a framework for using fair value to measure assets and liabilities and defines

fair value as the price that would be received to sell an asset or paid to transfer a liability (an exit price) as

opposed to the price that would be paid to acquire the asset or received to assume the liability (an entry price). A

fair value measure should reflect the assumptions that market participants would use in pricing the asset or

liability, including the assumptions about the risk inherent in a particular valuation technique, the effect of a

restriction on the sale or use of an asset and the risk of nonperformance. Required disclosures include

stratification of balance sheet amounts measured at fair value based on inputs the Company uses to derive fair

value measurements. These strata include:

• Level 1 valuations, where the valuation is based on quoted market prices for identical assets or

liabilities traded in active markets (which include exchanges and over-the-counter markets with

sufficient volume),

• Level 2 valuations, where the valuation is based on quoted market prices for similar instruments traded

in active markets, quoted prices for identical or similar instruments in markets that are not active and

model-based valuation techniques for which all significant assumptions are observable in the market,

and

• Level 3 valuations, where the valuation is generated from model-based techniques that use significant

assumptions not observable in the market, but observable based on Company-specific data. These

unobservable assumptions reflect the Company’s own estimates for assumptions that market

participants would use in pricing the asset or liability. Valuation techniques typically include option

pricing models, discounted cash flow models and similar techniques, but may also include the use of

market prices of assets or liabilities that are not directly comparable to the subject asset or liability.

ITEMS MEASURED AT FAIR VALUE ON A RECURRING BASIS

Trading account assets, securities available for sale, certain mortgage loans held for sale, mortgage servicing

rights, derivative assets, trading account liabilities and derivative liabilities are recorded at fair value on a

recurring basis. Below is a description of valuation methodologies for these assets and liabilities.

138