Regions Bank 2012 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2012 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

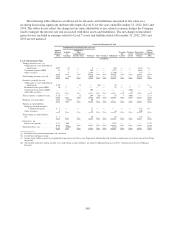

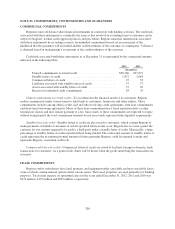

NOTE 23. COMMITMENTS, CONTINGENCIES AND GUARANTEES

COMMERCIAL COMMITMENTS

Regions issues off-balance sheet financial instruments in connection with lending activities. The credit risk

associated with these instruments is essentially the same as that involved in extending loans to customers and is

subject to Regions’ normal credit approval policies and procedures. Regions measures inherent risk associated

with these instruments by recording a reserve for unfunded commitments based on an assessment of the

likelihood that the guarantee will be funded and the creditworthiness of the customer or counterparty. Collateral

is obtained based on management’s assessment of the creditworthiness of the customer.

Credit risk associated with these instruments as of December 31 is represented by the contractual amounts

indicated in the following table:

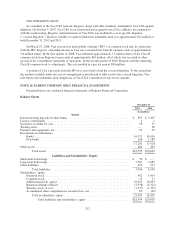

2012 2011

(In millions)

Unused commitments to extend credit ......................... $38,160 $37,872

Standby letters of credit .................................... 1,872 2,084

Commercial letters of credit ................................. 27 33

Liabilities associated with standby letters of credit ............... 37 37

Assets associated with standby letters of credit .................. 37 36

Reserve for unfunded credit commitments ...................... 83 78

Unused commitments to extend credit—To accommodate the financial needs of its customers, Regions

makes commitments under various terms to lend funds to consumers, businesses and other entities. These

commitments include (among others) credit card and other revolving credit agreements, term loan commitments

and short-term borrowing agreements. Many of these loan commitments have fixed expiration dates or other

termination clauses and may require payment of a fee. Since many of these commitments are expected to expire

without being funded, the total commitment amounts do not necessarily represent future liquidity requirements.

Standby letters of credit—Standby letters of credit are also issued to customers, which commit Regions to

make payments on behalf of customers if certain specified future events occur. Regions has recourse against the

customer for any amount required to be paid to a third party under a standby letter of credit. Historically, a large

percentage of standby letters of credit expired without being funded. The contractual amount of standby letters of

credit represents the maximum potential amount of future payments Regions could be required to make and

represents Regions’ maximum credit risk.

Commercial letters of credit—Commercial letters of credit are issued to facilitate foreign or domestic trade

transactions for customers. As a general rule, drafts will be drawn when the goods underlying the transaction are

in transit.

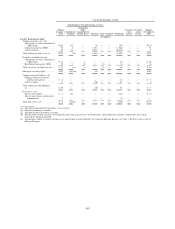

LEASE COMMITMENTS

Regions and its subsidiaries lease land, premises and equipment under cancelable and non-cancelable leases,

some of which contain renewal options under various terms. The leased properties are used primarily for banking

purposes. Total rental expense on operating leases for the years ended December 31, 2012, 2011 and 2010 was

$170 million, $197 million and $203 million, respectively.

208