Bank of America 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

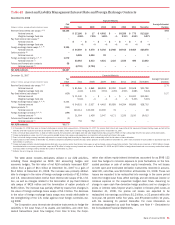

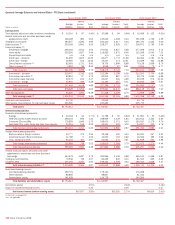

Table III Outstanding Loans and Leases

(Dollars in millions)

December 31

2008 2007 2006 2005 2004

Consumer

Residential mortgage

$247,999

$274,949 $241,181 $182,596 $178,079

Home equity

152,547

114,820 87,893 70,229 57,439

Discontinued real estate

(1)

19,981

n/a n/a n/a n/a

Credit card – domestic

64,128

65,774 61,195 58,548 51,726

Credit card – foreign

17,146

14,950 10,999 – –

Direct/Indirect consumer

(2)

83,436

76,538 59,206 37,265 33,113

Other consumer

(3)

3,442

4,170 5,231 6,819 7,526

Total consumer

588,679

551,201 465,705 355,457 327,883

Commercial

Commercial – domestic

(4)

219,233

208,297 161,982 140,533 122,095

Commercial real estate

(5)

64,701

61,298 36,258 35,766 32,319

Commercial lease financing

22,400

22,582 21,864 20,705 21,115

Commercial – foreign

31,020

28,376 20,681 21,330 18,401

Total commercial loans

337,354

320,553 240,785 218,334 193,930

Commercial loans measured at fair value

(6)

5,413

4,590 n/a n/a n/a

Total commercial

342,767

325,143 240,785 218,334 193,930

Total loans and leases

$931,446

$876,344 $706,490 $573,791 $521,813

(1) At December 31, 2008, includes $18.2 billion of pay option loans and $1.8 billion of subprime loans obtained as part of the acquisition of Countrywide. The Corporation no longer originates these products.

(2) Includes foreign consumer loans of $1.8 billion, $3.4 billion, $3.9 billion, $48 million, and $57 million at December 31, 2008, 2007, 2006, 2005, and 2004, respectively.

(3) Includes consumer finance loans of $2.6 billion, $3.0 billion, $2.8 billion, $2.8 billion, and $3.4 billion at December 31, 2008, 2007, 2006, 2005, and 2004, respectively; other foreign consumer loans of $618

million, $829 million, $2.3 billion, $3.8 billion, and $3.5 billion at December 31, 2008, 2007, 2006, 2005, and 2004, respectively; and consumer lease financing of $481 million at December 31, 2004.

(4) Includes small business commercial – domestic loans, primarily card related, of $19.1 billion, $19.3 billion, $15.2 billion, $7.2 billion and $5.4 billion at December 31, 2008, 2007, 2006, 2005 and 2004,

respectively.

(5) Includes domestic commercial real estate loans of $63.7 billion, $60.2 billion, $35.7 billion, $35.2 billion, and $31.9 billion at December 31, 2008, 2007, 2006, 2005, and 2004, respectively; and foreign

commercial real estate loans of $979 million, $1.1 billion, $578 million, $585 million, and $440 million at December 31, 2008, 2007, 2006, 2005, and 2004, respectively.

(6) Certain commercial loans are measured at fair value in accordance with SFAS 159 and include commercial – domestic loans of $3.5 billion and $3.5 billion, commercial – foreign loans of $1.7 billion and $790 million,

and commercial real estate loans of $203 million and $304 million at December 31, 2008 and 2007. See Note 19 – Fair Value Disclosures to the Consolidated Financial Statements for additional discussion of fair

value for certain financial instruments.

n/a = not applicable

Bank of America 2008

101