RBS 2008 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2008 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

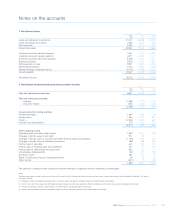

179RBS Group Annual Report and Accounts 2008

Fees in respect of services are recognised as the right to consideration

accrues through the provision of the service to the customer. The

arrangements are generally contractual and the cost of providing the

service is incurred as the service is rendered. The price is usually fixed

and always determinable. The application of this policy to significant fee

types is outlined below.

Payment services: this comprises income received for payment

services including cheques cashed, direct debits, Clearing House

Automated Payments (the UK electronic settlement system) and CHAPs

payments (the automated clearing house that processes direct debits

and direct credits). These are generally charged on a per transaction

basis. The income is earned when the payment or transaction occurs.

Charges for payment services are usually debited to the customer’s

account monthly or quarterly in arrears. Accruals are raised for services

provided but not charged at period end.

Card related services: fees from credit card business include:

•Commission received from retailers for processing credit and debit

card transactions: income is accrued to the income statement as the

service is performed;

•Interchange received: as issuer, the Group receives a fee

(interchange) each time a cardholder purchases goods and services.

The Group also receives interchange fees from other card issuers for

providing cash advances through its branch and Automated Teller

Machine networks. These fees are accrued once the transaction has

taken place; and

•An annual fee payable by a credit card holder is deferred and taken

to profit or loss over the period of the service i.e. 12 months.

Insurance brokerage: this is made up of fees and commissions

received from the agency sale of insurance. Commission on the sale of

an insurance contract is earned at the inception of the policy, as the

insurance has been arranged and placed. However, provision is made

where commission is refundable in the event of policy cancellation in

line with estimated cancellations.

Investment management fees: fees charged for managing investments

are recognised as revenue as the services are provided. Incremental

costs that are directly attributable to securing an investment

management contract are deferred and charged as expense as the

related revenue is recognised.

Insurance premiums: see accounting policy 12.

4. Assets held for sale and discontinued operations

A non-current asset (or disposal group) is classified as held for sale if

the Group will recover the carrying amount principally through a sale

transaction rather than through continuing use. A non-current asset (or

disposal group) classified as held for sale is measured at the lower of

its carrying amount and fair value less costs to sell. If the asset (or

disposal group) is acquired as part of a business combination it is

initially measured at fair value less costs to sell. Assets and liabilities of

disposal groups classified as held for sale and non-current assets

classified as held for sale are shown separately on the face of the

balance sheet.

The results of discontinued operations are shown as a single amount on

the face of the income statement comprising the post-tax profit or loss

of discontinued operations and the post-tax gain or loss recognised

either on measurement to fair value less costs to sell or on the disposal

of the discontinued operation. A discontinued operation is a cash-

generating unit or a group of cash-generating units that either has been

disposed of, or is classified as held for sale, and (a) represents a

separate major line of business or geographical area of operations, (b)

is part of a single co-ordinated plan to dispose of a separate major line

of business or geographical area of operations or (c) is a subsidiary

acquired exclusively with a view to resale.

5. Pensions and other post-retirement benefits

The Group provides post-retirement benefits in the form of pensions

and healthcare plans to eligible employees.

For defined benefit schemes, scheme liabilities are measured on an

actuarial basis using the projected unit credit method and discounted at

a rate that reflects the current rate of return on a high quality corporate

bond of equivalent term and currency to the scheme liabilities. Scheme

assets are measured at their fair value. Any surplus or deficit of scheme

assets over liabilities is recognised in the balance sheet as an asset

(surplus) or liability (deficit). The current service cost and any past

service costs together with the expected return on scheme assets less

the unwinding of the discount on the scheme liabilities is charged to

operating expenses. Actuarial gains and losses are recognised in full in

the period in which they occur outside profit or loss and presented in

the statement of recognised income and expense. Contributions to

defined contribution pension schemes are recognised in the income

statement when payable.

6. Intangible assets and goodwill

Intangible assets that are acquired by the Group are stated at cost less

accumulated amortisation and impairment losses. Amortisation is

charged to profit or loss over the assets’ estimated economic lives using

methods that best reflect the pattern of economic benefits and is

included in depreciation and amortisation. The estimated useful

economic lives are as follows:

Core deposit intangibles 6 to 10 years

Other acquired intangibles 5 to 10 years

Computer software 3 to 5 years

Expenditure on internally generated goodwill and brands is written-off

as incurred. Direct costs relating to the development of internal-use

computer software are capitalised once technical feasibility and

economic viability have been established. These costs include payroll,

the costs of materials and services, and directly attributable overheads.

Capitalisation of costs ceases when the software is capable of

operating as intended. During and after development, accumulated

costs are reviewed for impairment against the projected benefits that

the software is expected to generate. Costs incurred prior to the

establishment of technical feasibility and economic viability are

expensed as incurred as are all training costs and general overheads.

The costs of licences to use computer software that are expected to

generate economic benefits beyond one year are also capitalised.