RBS 2008 Annual Report Download - page 249

Download and view the complete annual report

Please find page 249 of the 2008 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299

|

|

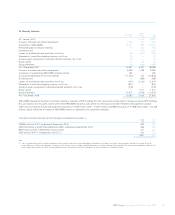

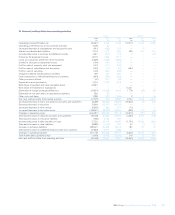

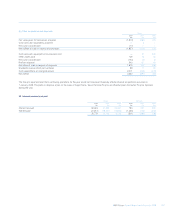

29 Leases (continued)

Residual value exposures

The tables below give details of the unguaranteed residual values included in the carrying value of finance lease receivables (see page 209) and

operating lease assets (see page 223).

Year in which residual value will be recovered

After 1 year After 2 years

Within 1 but within but within After 5

year 2 years 5 years years Total

2008 £m £m £m £m £m

Operating leases

Transportation 794 130 1,701 2,103 4,728

Cars and light commercial vehicles 577 195 182 8 962

Other 112 35 48 8 203

Finance leases 24 29 99 341 493

1,507 389 2,030 2,460 6,386

2007

Operating leases

Transportation 485 253 1,762 2,505 5,005

Cars and light commercial vehicles 331 467 118 — 916

Other 26 47 64 18 155

Finance leases 23 29 115 288 455

865 796 2,059 2,811 6,531

The Group provides asset finance to its customers through acting as a lessor. It purchases plant, equipment and intellectual property, renting them to

customers under lease arrangements that, depending on their terms, qualify as either operating or finance leases.

RBS Group Annual Report and Accounts 2008248

Notes on the accounts continued

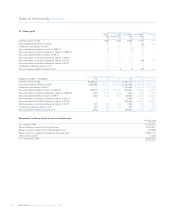

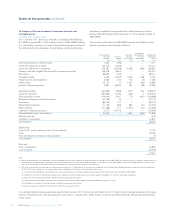

30 Collateral and securitisations

Securities repurchase agreements and lending transactions

The Group enters into securities repurchase agreements and securities

lending transactions under which it receives or transfers collateral in

accordance with normal market practice. Generally, the agreements

require additional collateral to be provided if the value of the securities

falls below a predetermined level.

Under standard terms for repurchase transactions in the UK and US

markets, the recipient of collateral has an unrestricted right to sell or

repledge it, subject to returning equivalent securities on settlement of

the transaction.

The fair value (and carrying value) of securities transferred under

repurchase transactions included within debt securities on the balance

sheet were £80,576 million (2007 – £107,651 million). All of these

securities could be sold or repledged by the holder. Securities received

as collateral under reverse repurchase agreements amounted to £89.3

billion (2007 – £373.7 billion), of which £49.0 billion (2007 – £337.8

billion) had been resold or repledged as collateral for the Group’s own

transactions.