Bank of America 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 Bank of America 2014

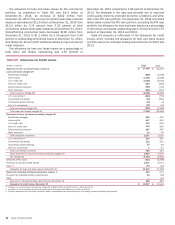

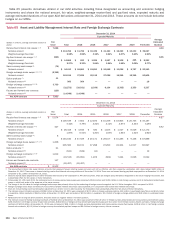

Table 65 presents derivatives utilized in our ALM activities including those designated as accounting and economic hedging

instruments and shows the notional amount, fair value, weighted-average receive-fixed and pay-fixed rates, expected maturity and

average estimated durations of our open ALM derivatives at December 31, 2014 and 2013. These amounts do not include derivative

hedges on our MSRs.

Table 65 Asset and Liability Management Interest Rate and Foreign Exchange Contracts

December 31, 2014

Expected Maturity

(Dollars in millions, average estimated duration in

years)

Fair

Value Total 2015 2016 2017 2018 2019 Thereafter

Average

Estimated

Duration

Receive-fixed interest rate swaps (1, 2) $ 7,626 4.34

Notional amount $ 113,766 $ 11,785 $ 15,339 $ 21,453 $ 15,299 $ 10,233 $ 39,657

Weighted-average fixed-rate 2.98% 3.56% 3.12%3.64%4.07%0.49%2.63%

Pay-fixed interest rate swaps (1, 2) (829) 8.05

Notional amount $ 14,668 $ 520 $ 1,025 $ 1,527 $ 2,908 $ 425 $ 8,263

Weighted-average fixed-rate 2.27% 2.30% 1.65%1.84%1.62%0.09%2.77%

Same-currency basis swaps (3) (74)

Notional amount $ 94,413 $ 18,881 $ 15,691 $ 21,068 $ 11,026 $ 6,787 $ 20,960

Foreign exchange basis swaps (2, 4, 5, 6) (2,352)

Notional amount 161,196 27,629 26,118 27,026 14,255 12,359 53,809

Option products (7) 11

Notional amount (8) 980 964 — — — —16

Foreign exchange contracts (2, 6, 9) 3,700

Notional amount (8) (22,572) (29,931) (2,036) 6,134 (2,335) 2,359 3,237

Futures and forward rate contracts (129)

Notional amount (8) (14,949) (14,949) — — — ——

Net ALM contracts $ 7,953

December 31, 2013

Expected Maturity

(Dollars in millions, average estimated duration in

years)

Fair

Value Total 2014 2015 2016 2017 2018 Thereafter

Average

Estimated

Duration

Receive-fixed interest rate swaps (1, 2) $ 5,074 4.67

Notional amount $109,539 $ 7,604 $ 12,873 $ 15,339 $ 19,803 $ 20,733 $ 33,187

Weighted-average fixed-rate 3.42% 3.79% 3.32% 3.12% 3.87% 3.34% 3.29%

Pay-fixed interest rate swaps (1, 2) 427 5.92

Notional amount $ 28,418 $ 4,645 $ 520 $ 1,025 $ 1,527 $ 8,529 $ 12,172

Weighted-average fixed-rate 1.87% 0.54% 2.30% 1.65% 1.84% 1.52% 2.62%

Same-currency basis swaps (3) 6

Notional amount $145,184 $ 47,529 $ 25,171 $ 28,157 $ 15,283 $ 9,156 $ 19,888

Foreign exchange basis swaps (2, 4, 5, 6) 1,208

Notional amount 205,560 39,151 37,298 27,293 24,304 14,517 62,997

Option products (7) 21

Notional amount (8) (641) (649) (11) — — — 19

Foreign exchange contracts (2, 6, 9) 1,619

Notional amount (8) (19,515) (35,991) 1,873 (669) 7,224 2,026 6,022

Futures and forward rate contracts 147

Notional amount (8) (19,427)(19,427)—————

Net ALM contracts $8,502

(1) The receive-fixed interest rate swap notional amounts that represent forward starting swaps and which will not be effective until their respective contractual start dates totaled $600 million at

December 31, 2013. There were no forward starting receive-fixed interest rate swap positions at December 31, 2014. There were no forward starting pay-fixed swap positions at December 31, 2014

compared to $1.1 billion at December 31, 2013.

(2) Does not include basis adjustments on either fixed-rate debt issued by the Corporation or AFS debt securities, which are hedged using derivatives designated as fair value hedging instruments, that

substantially offset the fair values of these derivatives.

(3) At December 31, 2014 and 2013, the notional amount of same-currency basis swaps was comprised of $94.4 billion and $145.2 billion in both foreign currency and U.S. Dollar-denominated basis

swaps in which both sides of the swap are in the same currency.

(4) The change in the fair value for foreign exchange basis swaps was primarily driven by the weakening of foreign currencies against the U.S. Dollar throughout 2014 compared to 2013.

(5) Foreign exchange basis swaps consisted of cross-currency variable interest rate swaps used separately or in conjunction with receive-fixed interest rate swaps.

(6) Does not include foreign currency translation adjustments on certain non-U.S. debt issued by the Corporation that substantially offset the fair values of these derivatives.

(7) The notional amount of option products of $980 million at December 31, 2014 was comprised of $974 million in foreign exchange options, $16 million in purchased caps/floors and $(10) million

in swaptions. Option products of $(641) million at December 31, 2013 were comprised of $(2.0) billion in swaptions, $1.4 billion in foreign exchange options and $19 million in purchased caps/

floors.

(8) Reflects the net of long and short positions. Amounts shown as negative reflect a net short position.

(9) The notional amount of foreign exchange contracts of $(22.6) billion at December 31, 2014 was comprised of $21.0 billion in foreign currency-denominated and cross-currency receive-fixed swaps,

$(36.4) billion in net foreign currency forward rate contracts, $(8.3) billion in foreign currency-denominated pay-fixed swaps and $1.1 billion in net foreign currency futures contracts. Foreign exchange

contracts of $(19.5) billion at December 31, 2013 were comprised of $36.1 billion in foreign currency-denominated and cross-currency receive-fixed swaps, $(49.3) billion in net foreign currency

forward rate contracts, $(10.3) billion in foreign currency-denominated pay-fixed swaps and $4.0 billion in foreign currency futures contracts.