Bank of America 2014 Annual Report Download - page 259

Download and view the complete annual report

Please find page 259 of the 2014 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Bank of America 2014 257

NOTE 23 Mortgage Servicing Rights

The Corporation accounts for consumer MSRs at fair value with

changes in fair value recorded in mortgage banking income in the

Consolidated Statement of Income. The Corporation manages the

risk in these MSRs with securities including MBS and U.S. Treasury

securities, as well as certain derivatives such as options and

interest rate swaps, which are not designated as accounting

hedges. The securities used to manage the risk in the MSRs are

classified in other assets with changes in the fair value of the

securities and the related interest income recorded in mortgage

banking income.

The table below presents activity for residential mortgage and

home equity MSRs for 2014 and 2013. Residential reverse

mortgage MSRs, which are carried at the lower of cost or fair value

and accounted for using the amortization method, totaled $10

million at December 31, 2013, and are not included in the tables

below.

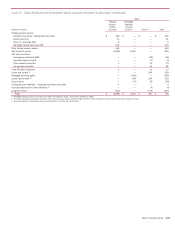

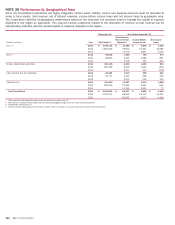

Rollforward of Mortgage Servicing Rights

(Dollars in millions) 2014 2013

Balance, January 1 $ 5,042 $ 5,716

Additions 707 472

Sales (61) (2,044)

Amortization of expected cash flows (1) (927) (1,043)

Impact of changes in interest rates and other market

factors (2) (1,191) 1,524

Model and other cash flow assumption changes: (3)

Projected cash flows, including changes in costs

to service loans (163) (27)

Impact of changes in the Home Price Index (25) (398)

Impact of changes to the prepayment model 243 609

Other model changes (4) (95) 233

Balance, December 31 (5) $ 3,530 $ 5,042

Mortgage loans serviced for investors (in billions) $ 490 $ 550

(1) Represents the net change in fair value of the MSR asset due to the recognition of modeled

cash flows.

(2) These amounts reflect the changes in modeled MSR fair value primarily due to observed changes

in interest rates, volatility, spreads and the shape of the forward swap curve.

(3) These amounts reflect periodic adjustments to the valuation model to reflect changes in the

modeled relationship between inputs and their impact on projected cash flows as well as

changes in certain cash flow assumptions such as cost to service and ancillary income per

loan.

(4) These amounts include the impact of periodic recalibrations of the model to reflect changes in

the relationship between market interest rate spreads and projected cash flows. Also included

is a decrease of $127 million for 2014 due to changes in option-adjusted spread rate

assumptions.

(5) At December 31, 2014, includes $3.3 billion of U.S. and $259 million of non-U.S. consumer

MSR balances.

The Corporation primarily uses an option-adjusted spread

(OAS) valuation approach which factors in prepayment risk to

determine the fair value of MSRs. This approach consists of

projecting servicing cash flows under multiple interest rate

scenarios and discounting these cash flows using risk-adjusted

discount rates. In addition to updating the valuation model for

interest, discount and prepayment rates, periodic adjustments are

made to recalibrate the valuation model for factors used to project

cash flows. The changes to the factors capture the effect of

variances related to actual versus estimated servicing proceeds.

Significant economic assumptions in estimating the fair value

of MSRs at December 31, 2014 and 2013 are presented below.

The change in fair value as a result of changes in OAS rates is

included within “Model and other cash flow assumption changes”

in the Rollforward of Mortgage Servicing Rights table. The weighted-

average life is not an input in the valuation model but is a product

of both changes in market rates of interest and changes in model

and other cash flow assumptions. The weighted-average life

represents the average period of time that the MSRs’ cash flows

are expected to be received. Absent other changes, an increase

(decrease) to the weighted-average life would generally result in

an increase (decrease) in the fair value of the MSRs.

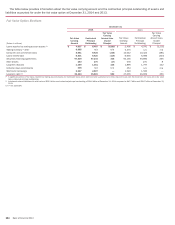

Significant Economic Assumptions

December 31

2014 2013

Fixed Adjustable Fixed Adjustable

Weighted-average OAS 4.52% 7.61% 3.97% 7.61%

Weighted-average life, in years 4.53 2.95 5.70 2.86

The table below presents the sensitivity of the weighted-

average lives and fair value of MSRs to changes in modeled

assumptions. These sensitivities are hypothetical and should be

used with caution. As the amounts indicate, changes in fair value

based on variations in assumptions generally cannot be

extrapolated because the relationship of the change in assumption

to the change in fair value may not be linear. Also, the effect of a

variation in a particular assumption on the fair value of MSRs that

continue to be held by the Corporation is calculated without

changing any other assumption. In reality, changes in one factor

may result in changes in another, which might magnify or counteract

the sensitivities. The below sensitivities do not reflect any hedge

strategies that may be undertaken to mitigate such risk.

Sensitivity Impacts

December 31, 2014

Change in

Weighted-average Lives

(Dollars in millions) Fixed Adjustable

Change in

Fair Value

Prepayment rates

Impact of 10% decrease 0.23 years 0.19 years $ 232

Impact of 20% decrease 0.50 0.40 494

Impact of 10% increase (0.21) (0.16) (208)

Impact of 20% increase (0.39) (0.31) (395)

OAS level

Impact of 100 bps decrease $ 158

Impact of 200 bps decrease 329

Impact of 100 bps increase (146)

Impact of 200 bps increase (281)