Bank of America 2014 Annual Report Download - page 252

Download and view the complete annual report

Please find page 252 of the 2014 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

250 Bank of America 2014

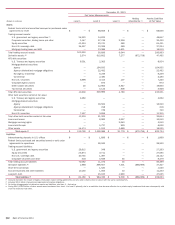

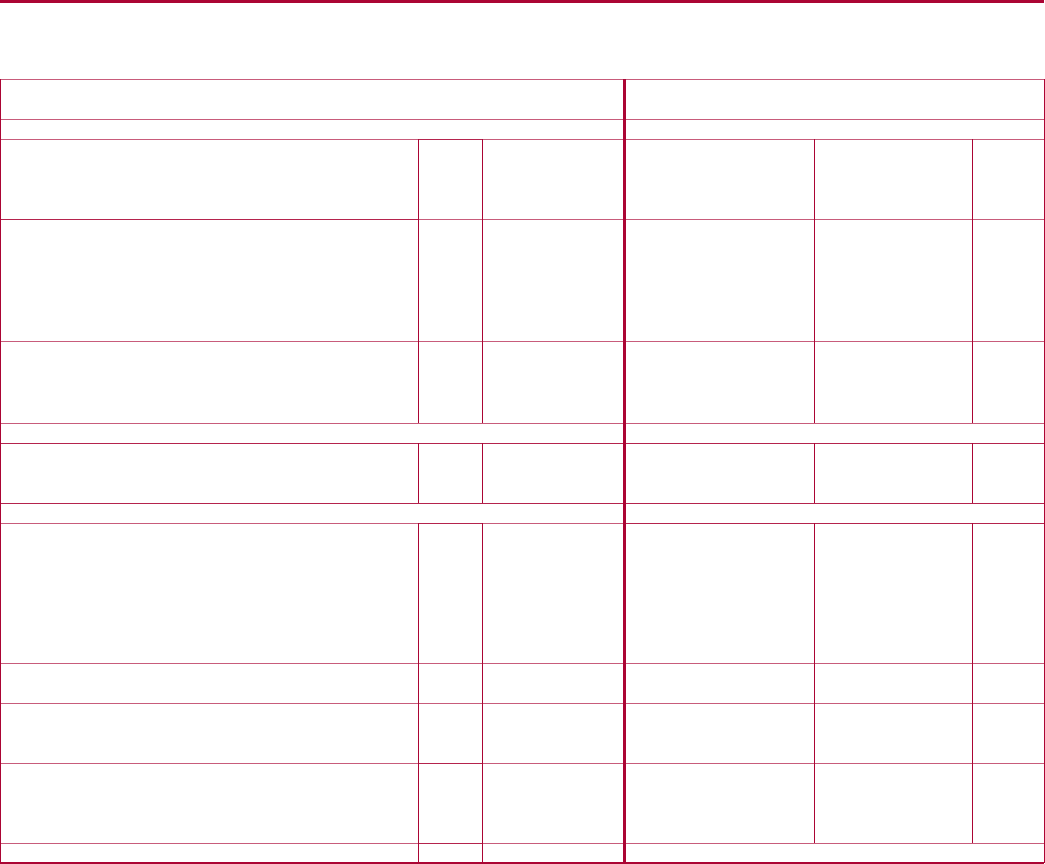

Quantitative Information about Level 3 Fair Value Measurements at December 31, 2013

(Dollars in millions) Inputs

Financial Instrument

Fair

Value

Valuation

Technique

Significant Unobservable

Inputs

Ranges of

Inputs

Weighted

Average

Loans and Securities (1)

Instruments backed by residential real estate assets $ 3,443

Discounted cash flow,

Market comparables

Yield 2% to 25% 6%

Trading account assets – Mortgage trading loans and ABS 363 Prepayment speed 0% to 35% CPR 9%

Loans and leases 2,151 Default rate 1% to 20% CDR 6%

Loans held-for-sale 929 Loss severity 21% to 80% 35%

Commercial loans, debt securities and other $ 12,135

Discounted cash flow,

Market comparables

Yield 0% to 45% 5%

Trading account assets – Corporate securities, trading loans and other 3,462 Enterprise value/EBITDA multiple 0x to 24x 7x

Trading account assets – Non-U.S. sovereign debt 468 Prepayment speed 5% to 40% 19%

Trading account assets – Mortgage trading loans and ABS 4,268 Default rate 1% to 5% 4%

AFS debt securities – Other taxable securities 3,031 Loss severity 25% to 42% 36%

Loans and leases 906 Duration 1 year to 5 years 4 years

Auction rate securities $ 1,719

Discounted cash flow,

Market comparables

Projected tender price/

Refinancing level

60% to 100% 96%

Trading account assets – Corporate securities, trading loans and other 97

AFS debt securities – Other taxable securities 816

AFS debt securities – Tax-exempt securities 806

Structured liabilities

Long-term debt $ (1,990)

Industry standard

derivative pricing (2, 3)

Equity correlation 18% to 98% 70%

Long-dated equity volatilities 4% to 63% 27%

Long-dated volatilities (IR) 0% to 2% 1%

Net derivative assets

Credit derivatives $ 808

Discounted cash flow,

Stochastic recovery

correlation model

Yield 3% to 25% 14%

Upfront points 0 points to 100 points 63 points

Spread to index -1,407 bps to 1,741 bps 91 bps

Credit correlation 14% to 99% 47%

Prepayment speed 3% to 40% CPR 13%

Default rate 1% to 5% CDR 3%

Loss severity 20% to 42% 35%

Equity derivatives $ (1,596) Industry standard

derivative pricing (2)

Equity correlation 18% to 98% 70%

Long-dated equity volatilities 4% to 63% 27%

Commodity derivatives $ 6 Discounted cash flow,

Industry standard

derivative pricing (2)

Natural gas forward price $3/MMBtu to $11/MMBtu $6/MMBtu

Correlation 47% to 89% 81%

Volatilities 9% to 109% 30%

Interest rate derivatives $ 558

Industry standard

derivative pricing (3)

Correlation (IR/IR) 24% to 99% 60%

Correlation (FX/IR) -30% to 40% -4%

Long-dated inflation rates 0% to 3% 2%

Long-dated inflation volatilities 0% to 2% 1%

Total net derivative assets $ (224)

(1) The categories are aggregated based upon product type which differs from financial statement classification. The following is a reconciliation to the line items in the table on page 244: Trading

account assets – Corporate securities, trading loans and other of $3.6 billion, Trading account assets – Non-U.S. sovereign debt of $468 million, Trading account assets – Mortgage trading loans

and ABS of $4.6 billion, AFS debt securities – Other taxable securities of $3.8 billion, AFS debt securities – Tax-exempt securities of $806 million, Loans and leases of $3.1 billion and LHFS of $929

million.

(2) Includes models such as Monte Carlo simulation and Black-Scholes.

(3) Includes models such as Monte Carlo simulation, Black-Scholes and other methods that model the joint dynamics of interest, inflation and foreign exchange rates.

CPR = Constant Prepayment Rate

CDR = Constant Default Rate

EBITDA = Earnings before interest, taxes, depreciation and amortization

MMBtu = Million British thermal units

IR = Interest Rate

FX = Foreign Exchange