Bank of America 2014 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2014 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

158 Bank of America 2014

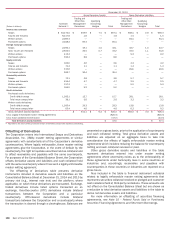

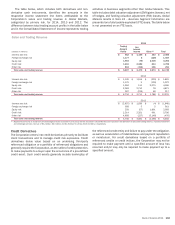

December 31, 2013

Gross Derivative Assets Gross Derivative Liabilities

(Dollars in billions)

Contract/

Notional (1)

Trading and

Other Risk

Management

Derivatives

Qualifying

Accounting

Hedges Total

Trading and

Other Risk

Management

Derivatives

Qualifying

Accounting

Hedges Total

Interest rate contracts

Swaps $ 33,272.0 $ 659.9 $ 7.5 $ 667.4 $ 658.4 $ 0.9 $ 659.3

Futures and forwards 8,217.6 1.6 — 1.6 1.5 — 1.5

Written options 2,065.4 — — — 64.4 — 64.4

Purchased options 2,028.3 65.4 — 65.4 — — —

Foreign exchange contracts

Swaps 2,284.1 43.1 1.0 44.1 42.7 1.0 43.7

Spot, futures and forwards 2,922.5 32.5 0.7 33.2 33.5 1.1 34.6

Written options 412.4 — — — 9.2 — 9.2

Purchased options 392.4 8.8 — 8.8 — — —

Equity contracts

Swaps 162.0 3.6 — 3.6 4.2 — 4.2

Futures and forwards 71.4 1.1 — 1.1 1.4 — 1.4

Written options 315.6 — — — 29.6 — 29.6

Purchased options 266.7 30.4 — 30.4 — — —

Commodity contracts

Swaps 73.1 3.8 — 3.8 5.7 — 5.7

Futures and forwards 454.4 4.7 — 4.7 2.5 — 2.5

Written options 157.3 — — — 5.0 — 5.0

Purchased options 164.0 5.2 — 5.2 — — —

Credit derivatives

Purchased credit derivatives:

Credit default swaps 1,305.1 15.7 — 15.7 28.1 — 28.1

Total return swaps/other 38.1 2.0 — 2.0 3.2 — 3.2

Written credit derivatives:

Credit default swaps 1,265.4 29.3 — 29.3 13.8 — 13.8

Total return swaps/other 63.4 4.0 — 4.0 0.2 — 0.2

Gross derivative assets/liabilities $ 911.1 $ 9.2 $ 920.3 $ 903.4 $ 3.0 $ 906.4

Less: Legally enforceable master netting agreements (825.5) (825.5)

Less: Cash collateral received/paid (47.3) (43.5)

Total derivative assets/liabilities $ 47.5 $ 37.4

(1) Represents the total contract/notional amount of derivative assets and liabilities outstanding.

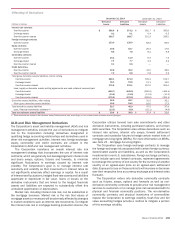

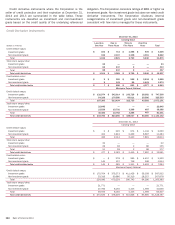

Offsetting of Derivatives

The Corporation enters into International Swaps and Derivatives

Association, Inc. (ISDA) master netting agreements or similar

agreements with substantially all of the Corporation’s derivative

counterparties. Where legally enforceable, these master netting

agreements give the Corporation, in the event of default by the

counterparty, the right to liquidate securities held as collateral and

to offset receivables and payables with the same counterparty.

For purposes of the Consolidated Balance Sheet, the Corporation

offsets derivative assets and liabilities and cash collateral held

with the same counterparty where it has such a legally enforceable

master netting agreement.

The Offsetting of Derivatives table presents derivative

instruments included in derivative assets and liabilities on the

Consolidated Balance Sheet at December 31, 2014 and 2013 by

primary risk (e.g., interest rate risk) and the platform, where

applicable, on which these derivatives are transacted. Exchange-

traded derivatives include listed options transacted on an

exchange. Over-the-counter (OTC) derivatives include bilateral

transactions between the Corporation and a particular

counterparty. OTC-cleared derivatives include bilateral

transactions between the Corporation and a counterparty where

the transaction is cleared through a clearinghouse. Balances are

presented on a gross basis, prior to the application of counterparty

and cash collateral netting. Total gross derivative assets and

liabilities are adjusted on an aggregate basis to take into

consideration the effects of legally enforceable master netting

agreements which includes reducing the balance for counterparty

netting and cash collateral received or paid.

Other gross derivative assets and liabilities in the table

represent derivatives entered into under master netting

agreements where uncertainty exists as to the enforceability of

these agreements under bankruptcy laws in some countries or

industries and, accordingly, receivables and payables with

counterparties in these countries or industries are reported on a

gross basis.

Also included in the table is financial instrument collateral

related to legally enforceable master netting agreements that

represents securities collateral received or pledged and customer

cash collateral held at third-party custodians. These amounts are

not offset on the Consolidated Balance Sheet but are shown as

a reduction to total derivative assets and liabilities in the table to

derive net derivative assets and liabilities.

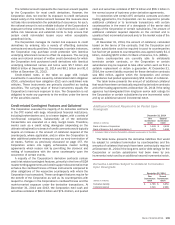

For more information on offsetting of securities financing

agreements, see Note 10 – Federal Funds Sold or Purchased,

Securities Financing Agreements and Short-term Borrowings.