Bank of America 2014 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2014 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.156 Bank of America 2014

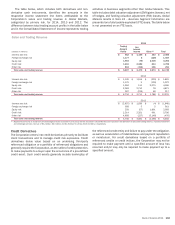

Revenue Recognition

The following summarizes the Corporation’s revenue recognition

policies as they relate to certain noninterest income line items in

the Consolidated Statement of Income.

Card income is derived from fees such as interchange, cash

advance, annual, late, over-limit and other miscellaneous fees,

which are recorded as revenue when earned, primarily on an

accrual basis. Uncollected fees are included in the customer card

receivables balances with an amount recorded in the allowance

for loan and lease losses for estimated uncollectible card

receivables. Uncollected fees are written off when a card receivable

reaches 180 days past due.

Service charges include fees for insufficient funds, overdrafts

and other banking services and are recorded as revenue when

earned. Uncollected fees are included in outstanding loan

balances with an amount recorded for estimated uncollectible

service fees receivable. Uncollected fees are written off when a

fee receivable reaches 60 days past due.

Investment and brokerage services revenue consists primarily

of asset management fees and brokerage income that are

recognized over the period the services are provided or when

commissions are earned. Asset management fees consist

primarily of fees for investment management and trust services

and are generally based on the dollar amount of the assets being

managed. Brokerage income is generally derived from

commissions and fees earned on the sale of various financial

products.

Investment banking income consists primarily of advisory and

underwriting fees that are recognized in income as the services

are provided and no contingencies exist. Revenues are generally

recognized net of any direct expenses. Non-reimbursed expenses

are recorded as noninterest expense.

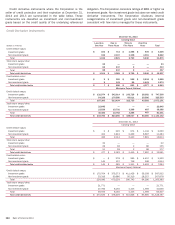

Earnings Per Common Share

Earnings per common share (EPS) is computed by dividing net

income (loss) allocated to common shareholders by the weighted-

average common shares outstanding, except that it does not

include unvested common shares subject to repurchase or

cancellation. Net income (loss) allocated to common shareholders

represents net income (loss) applicable to common shareholders

which is net income (loss) adjusted for preferred stock dividends

including dividends declared, accretion of discounts on preferred

stock including accelerated accretion when preferred stock is

repaid early, and cumulative dividends related to the current

dividend period that have not been declared as of period end, less

income allocated to participating securities (see below for more

information). Diluted EPS is computed by dividing income (loss)

allocated to common shareholders plus dividends on dilutive

convertible preferred stock and preferred stock that can be

tendered to exercise warrants, by the weighted-average common

shares outstanding plus amounts representing the dilutive effect

of stock options outstanding, restricted stock, restricted stock

units, outstanding warrants and the dilution resulting from the

conversion of convertible preferred stock, if applicable.

Unvested share-based payment awards that contain

nonforfeitable rights to dividends are participating securities that

are included in computing EPS using the two-class method. The

two-class method is an earnings allocation formula under which

EPS is calculated for common stock and participating securities

according to dividends declared and participating rights in

undistributed earnings. Under this method, all earnings,

distributed and undistributed, are allocated to participating

securities and common shares based on their respective rights to

receive dividends.

In an exchange of non-convertible preferred stock, income

allocated to common shareholders is adjusted for the difference

between the carrying value of the preferred stock and the fair value

of the consideration exchanged. In an induced conversion of

convertible preferred stock, income allocated to common

shareholders is reduced by the excess of the fair value of the

consideration exchanged over the fair value of the common stock

that would have been issued under the original conversion terms.

Foreign Currency Translation

Assets, liabilities and operations of foreign branches and

subsidiaries are recorded based on the functional currency of each

entity. For certain of the foreign operations, the functional currency

is the local currency, in which case the assets, liabilities and

operations are translated, for consolidation purposes, from the

local currency to the U.S. Dollar reporting currency at period-end

rates for assets and liabilities and generally at average rates for

results of operations. The resulting unrealized gains or losses, as

well as gains and losses from certain hedges, are reported as a

component of accumulated OCI, net-of-tax. When the foreign

entity’s functional currency is determined to be the U.S. Dollar, the

resulting remeasurement gains or losses on foreign currency-

denominated assets or liabilities are included in earnings.

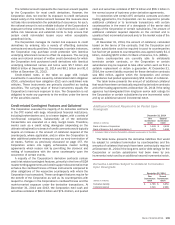

Credit Card and Deposit Arrangements

Endorsing Organization Agreements

The Corporation contracts with other organizations to obtain their

endorsement of the Corporation’s loan and deposit products. This

endorsement may provide to the Corporation exclusive rights to

market to the organization’s members or to customers on behalf

of the Corporation. These organizations endorse the Corporation’s

loan and deposit products and provide the Corporation with their

mailing lists and marketing activities. These agreements generally

have terms that range from two to five years. The Corporation

typically pays royalties in exchange for the endorsement.

Compensation costs related to the credit card agreements are

recorded as contra-revenue in card income.

Cardholder Reward Agreements

The Corporation offers reward programs that allow its cardholders

to earn points that can be redeemed for a broad range of rewards

including cash, travel and gift cards. The Corporation establishes

a rewards liability based upon the points earned that are expected

to be redeemed and the average cost per point redeemed. The

points to be redeemed are estimated based on past redemption

behavior, card product type, account transaction activity and other

historical card performance. The liability is reduced as the points

are redeemed. The estimated cost of the rewards programs is

recorded as contra-revenue in card income.