Bank of America 2013 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2013 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.160 Bank of America 2013

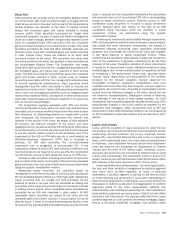

to accrual status when all principal and interest is current and full

repayment of the remaining contractual principal and interest is

expected, or when the loan otherwise becomes well-secured and

is in the process of collection. The outstanding balance of real

estate-secured loans that is in excess of the estimated property

value less costs to sell is charged off no later than the end of the

month in which the loan becomes 180 days past due unless the

loan is fully insured. The estimated property value less costs to

sell is determined using the same process as described for

impaired loans in the Allowance for Credit Losses in this Note.

Consumer loans secured by personal property, credit card loans

and other unsecured consumer loans are not placed on nonaccrual

status prior to charge-off and, therefore, are not reported as

nonperforming loans, except for certain secured consumer loans,

including those that have been modified in a TDR. Personal

property-secured loans are charged off to collateral value no later

than the end of the month in which the account becomes 120

days past due or, for loans in bankruptcy, 60 days past due. Credit

card and other unsecured consumer loans are charged off no later

than the end of the month in which the account becomes 180

days past due or within 60 days after receipt of notification of

death or bankruptcy.

Commercial loans and leases, excluding business card loans,

that are past due 90 days or more as to principal or interest, or

where reasonable doubt exists as to timely collection, including

loans that are individually identified as being impaired, are

generally placed on nonaccrual status and classified as

nonperforming unless well-secured and in the process of

collection.

Accrued interest receivable is reversed when commercial loans

and leases are placed on nonaccrual status. Interest collections

on nonaccruing commercial loans and leases for which the

ultimate collectability of principal is uncertain are applied as

principal reductions; otherwise, such collections are credited to

income when received. Commercial loans and leases may be

restored to accrual status when all principal and interest is current

and full repayment of the remaining contractual principal and

interest is expected, or when the loan otherwise becomes well-

secured and is in the process of collection. Business card loans

are charged off no later than the end of the month in which the

account becomes 180 days past due or 60 days after receipt of

notification of death or bankruptcy. These loans are not placed on

nonaccrual status prior to charge-off and, therefore, are not

reported as nonperforming loans. Other commercial loans and

leases are generally charged off when all or a portion of the

principal amount is determined to be uncollectible.

The entire balance of a consumer loan or commercial loan or

lease is contractually delinquent if the minimum payment is not

received by the specified due date on the customer’s billing

statement. Interest and fees continue to accrue on past due loans

and leases until the date the loan is placed on nonaccrual status,

if applicable.

PCI loans are recorded at fair value at the acquisition date.

Although the PCI loans may be contractually delinquent, the

Corporation does not classify these loans as nonperforming as

the loans were written down to fair value at the acquisition date

and the accretable yield is recognized in interest income over the

remaining life of the loan. In addition, reported net charge-offs

exclude write-offs on PCI loans as the fair value already considers

the estimated credit losses.

Troubled Debt Restructurings

Consumer loans and commercial loans and leases whose

contractual terms have been restructured in a manner that grants

a concession to a borrower experiencing financial difficulties are

classified as TDRs. Concessions could include a reduction in the

interest rate to a rate that is below market on the loan, payment

extensions, forgiveness of principal, forbearance, or other actions

designed to maximize collections. Secured consumer loans that

have been discharged in Chapter 7 bankruptcy and have not been

reaffirmed by the borrower are classified as TDRs at the time of

discharge. Consumer real estate-secured loans for which a binding

offer to restructure has been extended are also classified as TDRs.

Loans classified as TDRs are considered impaired loans. Loans

that are carried at fair value, LHFS and PCI loans are not classified

as TDRs.

Secured consumer loans whose contractual terms have been

modified in a TDR and are current at the time of restructuring

generally remain on accrual status if there is demonstrated

performance prior to the restructuring and payment in full under

the restructured terms is expected. Otherwise, the loans are

placed on nonaccrual status and reported as nonperforming,

except for the fully-insured loans, until there is sustained

repayment performance for a reasonable period, generally six

months. If accruing consumer TDRs cease to perform in

accordance with their modified contractual terms, they are placed

on nonaccrual status and reported as nonperforming TDRs.

Consumer TDRs that bear a below-market rate of interest are

generally reported as TDRs throughout their remaining lives.

Secured consumer loans that have been discharged in Chapter 7

bankruptcy are placed on nonaccrual status and written down to

the estimated collateral value less costs to sell no later than at

the time of discharge. If these loans are contractually current,

interest collections are generally recorded in interest income on

a cash basis. Credit card and other unsecured consumer loans

that have been renegotiated in a TDR are not placed on nonaccrual

status. Credit card and other unsecured consumer loans that have

been renegotiated and placed on a fixed payment plan after July

1, 2012 are generally charged off no later than the end of the

month in which the account becomes 120 days past due.

Commercial loans and leases whose contractual terms have

been modified in a TDR are typically placed on nonaccrual status

and reported as nonperforming until the loans or leases have

performed for an adequate period of time under the restructured

agreement, generally six months. If the borrower had

demonstrated performance under the previous terms and the

underwriting process shows the capacity to continue to perform

under the modified terms, the loan may remain on accrual status.

Accruing commercial TDRs are reported as performing TDRs

through the end of the calendar year in which the loans are returned

to accrual status. In addition, if accruing commercial TDRs bear

less than a market rate of interest at the time of modification, they

are reported as performing TDRs throughout their remaining lives

unless and until they cease to perform in accordance with their

modified contractual terms, at which time they are placed on

nonaccrual status and reported as nonperforming TDRs.

A loan that had previously been modified in a TDR and is

subsequently refinanced under current underwriting standards at

a market rate with no concessionary terms is accounted for as a

new loan and is no longer reported as a TDR.