Bank of America 2013 Annual Report Download - page 243

Download and view the complete annual report

Please find page 243 of the 2013 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Bank of America 2013 241

NOTE 17 Employee Benefit Plans

Pension and Postretirement Plans

The Corporation sponsors noncontributory trusteed pension plans,

a number of noncontributory nonqualified pension plans, and

postretirement health and life plans that cover eligible employees.

As discussed below, certain of the pension plans were amended,

effective June 30, 2012, to freeze benefits earned. The pension

plans provide defined benefits based on an employee’s

compensation and years of service. The Bank of America Pension

Plan (the Pension Plan) provides participants with compensation

credits, generally based on years of service. In 2013, the

Corporation merged a defined benefit pension plan, which covered

eligible employees of certain legacy companies, into the Bank of

America Pension Plan. This plan is referred to as the Qualified

Pension Plan (Qualified Pension Plans prior to this merger). For

account balances based on compensation credits prior to January

1, 2008, the Pension Plan allows participants to select from

various earnings measures, which are based on the returns of

certain funds or common stock of the Corporation. The participant-

selected earnings measures determine the earnings rate on the

individual participant account balances in the Pension Plan.

Participants may elect to modify earnings measure allocations on

a periodic basis subject to the provisions of the Pension Plan. For

account balances based on compensation credits subsequent to

December 31, 2007, the account balance earnings rate is based

on a benchmark rate. For eligible employees in the Pension Plan

on or after January 1, 2008, the benefits become vested upon

completion of three years of service. It is the policy of the

Corporation to fund no less than the minimum funding amount

required by ERISA.

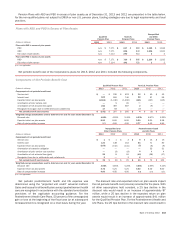

The Pension Plan has a balance guarantee feature for account

balances with participant-selected earnings, applied at the time a

benefit payment is made from the plan that effectively provides

principal protection for participant balances transferred and

certain compensation credits. The Corporation is responsible for

funding any shortfall on the guarantee feature.

As a result of acquisitions, the Corporation assumed the

obligations related to the pension plans of certain legacy

companies. The benefit structures under these acquired plans

have not changed and remain intact in the merged plan. Certain

benefit structures are substantially similar to the Pension Plan

discussed above; however, certain of these structures do not allow

participants to select various earnings measures; rather the

earnings rate is based on a benchmark rate. In addition, these

structures include participants with benefits determined under

formulas based on average or career compensation and years of

service rather than by reference to a pension account. Certain of

the other structures provide a participant’s retirement benefits

based on the number of years of benefit service and a percentage

of the participant’s average annual compensation during the five

highest paid consecutive years of the last 10 years of employment.

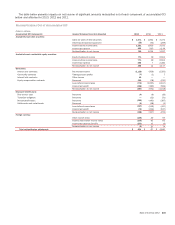

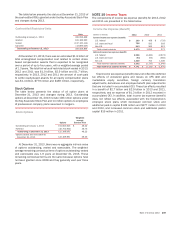

The 2013 merger of the defined benefit pension plan into the

Qualified Pension Plan required a remeasurement of the qualified

pension obligations and plan assets at fair value as of the merger

date in addition to the required December 31 remeasurement. The

2013 remeasurements resulted in an increase in accumulated

OCI of $2.0 billion, net-of-tax.

In 2012, in connection with a redesign of the Corporation’s

retirement plans, the Compensation and Benefits Committee of

the Board approved amendments to freeze benefits earned in the

Qualified Pension Plans effective June 30, 2012. As a result of

freezing the Qualified Pension Plans, a curtailment was triggered

and a remeasurement of the qualified pension obligations and

plan assets occurred. As of the remeasurement date, the plan

assets had increased in value from the prior measurement date

resulting in an increase in the funded status of the plan and the

curtailment impact reduced the projected benefit obligation. The

combined impact resulted in a $1.3 billion increase to the net

pension assets recognized in other assets and a corresponding

increase in accumulated OCI of $832 million, net-of-tax. The impact

of the immediate recognition of the prior service cost of $58 million

was recorded in personnel expense as a curtailment loss in 2012.

All economic assumptions were consistent with the prior year end

including the weighted-average discount rate of 4.95 percent used

for remeasurement of the Qualified Pension Plans.

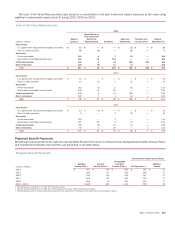

As a result of freezing the Qualified Pension Plans, the

amortization period for actuarial gains and losses was changed

from the average working life to the estimated average lifetime of

benefits being paid. In addition, in 2014, the long-term expected

return on assets assumption for the Qualified Pension Plan was

reduced to 6.0 percent from 6.5 percent in 2013 and 8.0 percent

in 2012 to reflect current market conditions and long-term financial

goals.

The Corporation assumed the obligations related to the plans

of Merrill Lynch. These plans include a terminated U.S. pension

plan (the Other Pension Plan), non-U.S. pension plans, nonqualified

pension plans and postretirement plans. The non-U.S. pension

plans vary based on the country and local practices.

The Corporation has an annuity contract, previously purchased

by Merrill Lynch, that guarantees the payment of benefits vested

under the Other Pension Plan. The Corporation, under a

supplemental agreement, may be responsible for, or benefit from

actual experience and investment performance of the annuity

assets. The Corporation made no contribution under this

agreement in 2013 or 2012. Contributions may be required in the

future under this agreement.

The Corporation sponsors a number of noncontributory,

nonqualified pension plans (the Nonqualified Pension Plans). As

a result of acquisitions, the Corporation assumed the obligations

related to the noncontributory, nonqualified pension plans of

certain legacy companies including Merrill Lynch. These plans,

which are unfunded, provide defined pension benefits to certain

employees.

In addition to retirement pension benefits, full-time, salaried

employees and certain part-time employees may become eligible

to continue participation as retirees in health care and/or life

insurance plans sponsored by the Corporation. Based on the other

provisions of the individual plans, certain retirees may also have

the cost of these benefits partially paid by the Corporation. The

obligations assumed as a result of acquisitions are substantially

similar to the Corporation’s postretirement health and life plans,

except for Countrywide which did not have a postretirement health

and life plan. Collectively, these plans are referred to as the

Postretirement Health and Life Plans.

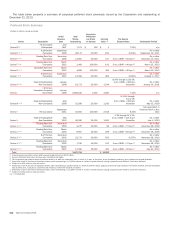

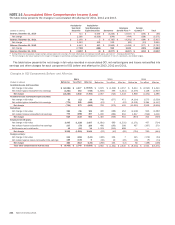

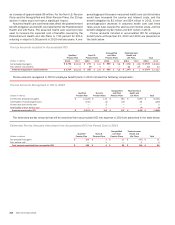

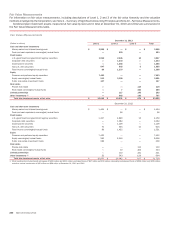

The Pension and Postretirement Plans table summarizes the

changes in the fair value of plan assets, changes in the projected

benefit obligation (PBO), the funded status of both the

accumulated benefit obligation (ABO) and the PBO, and the

weighted-average assumptions used to determine benefit

obligations for the pension plans and postretirement plans at

December 31, 2013 and 2012. Amounts recognized at December

31, 2013 and 2012 are reflected in other assets, and in accrued

expenses and other liabilities on the Consolidated Balance Sheet.