Bank of America 2013 Annual Report Download - page 194

Download and view the complete annual report

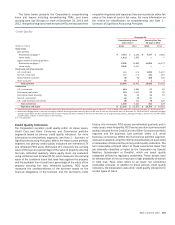

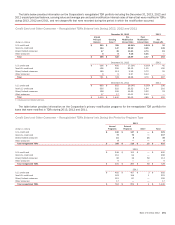

Please find page 194 of the 2013 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.192 Bank of America 2013

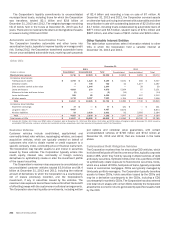

Credit card and other consumer loans are deemed to be in

payment default during the quarter in which a borrower misses the

second of two consecutive payments. Payment defaults are one

of the factors considered when projecting future cash flows in the

calculation of the allowance for loan and lease losses for impaired

credit card and other consumer loans. Based on historical

experience, the Corporation estimates that 21 percent of new U.S.

credit card TDRs, 70 percent of new non-U.S. credit card TDRs and

13 percent of new direct/indirect consumer TDRs may be in

payment default within 12 months after modification. Loans that

entered into payment default during 2013, 2012 and 2011 that

had been modified in a TDR during the preceding 12 months were

$61 million, $203 million and $863 million for U.S. credit card,

$236 million, $298 million and $409 million for non-U.S. credit

card, and $12 million, $35 million and $180 million for direct/

indirect consumer, respectively.

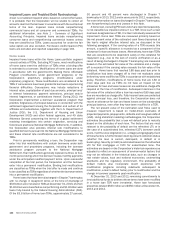

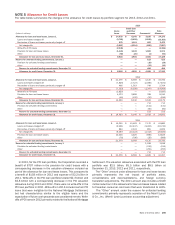

Commercial Loans

Impaired commercial loans, which include nonperforming loans

and TDRs (both performing and nonperforming), are primarily

measured based on the present value of payments expected to

be received, discounted at the loan’s original effective interest

rate. Commercial impaired loans may also be measured based on

observable market prices or, for loans that are solely dependent

on the collateral for repayment, the estimated fair value of

collateral less costs to sell. If the carrying value of a loan exceeds

this amount, a specific allowance is recorded as a component of

the allowance for loan and lease losses.

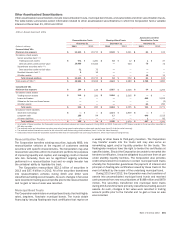

Modifications of loans to commercial borrowers that are

experiencing financial difficulty are designed to reduce the

Corporation’s loss exposure while providing the borrower with an

opportunity to work through financial difficulties, often to avoid

foreclosure or bankruptcy. Each modification is unique and reflects

the individual circumstances of the borrower. Modifications that

result in a TDR may include extensions of maturity at a

concessionary (below market) rate of interest, payment

forbearances or other actions designed to benefit the customer

while mitigating the Corporation’s risk exposure. Reductions in

interest rates are rare. Instead, the interest rates are typically

increased, although the increased rate may not represent a market

rate of interest. Infrequently, concessions may also include

principal forgiveness in connection with foreclosure, short sale or

other settlement agreements leading to termination or sale of the

loan.

At the time of restructuring, the loans are remeasured to reflect

the impact, if any, on projected cash flows resulting from the

modified terms. If there was no forgiveness of principal and the

interest rate was not decreased, the modification may have little

or no impact on the allowance established for the loan. If a portion

of the loan is deemed to be uncollectible, a charge-off may be

recorded at the time of restructuring. Alternatively, a charge-off

may have already been recorded in a previous period such that no

charge-off is required at the time of modification. For more

information on modifications for the U.S. small business

commercial portfolio, see Credit Card and Other Consumer in this

Note.

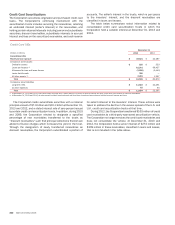

At December 31, 2013 and 2012, remaining commitments to

lend additional funds to debtors whose terms have been modified

in a commercial loan TDR were immaterial. Commercial foreclosed

properties totaled $90 million and $250 million at December 31,

2013 and 2012.