Bank of America 2013 Annual Report Download - page 271

Download and view the complete annual report

Please find page 271 of the 2013 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Bank of America 2013 269

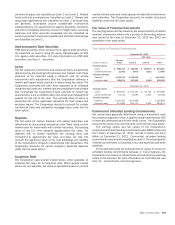

commercial paper, are classified as Level 1 and Level 2. Federal

funds sold and purchased are classified as Level 2. Resale and

repurchase agreements are classified as Level 2 because they

are generally short-dated and/or variable-rate instruments

collateralized by U.S. government or agency securities. Customer

and other receivables primarily consist of margin loans, servicing

advances and other accounts receivable and are classified as

Level 2 and Level 3. Customer payables and short-term borrowings

are classified as Level 2.

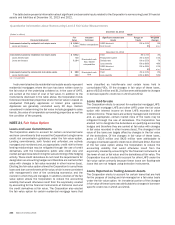

Held-to-maturity Debt Securities

HTM debt securities, which consist of U.S. agency debt securities,

are classified as Level 2 using the same methodologies as AFS

U.S. agency debt securities. For more information on HTM debt

securities, see Note 3 – Securities.

Loans

The fair values for commercial and consumer loans are generally

determined by discounting both principal and interest cash flows

expected to be collected using a discount rate for similar

instruments with adjustments that the Corporation believes a

market participant would consider in determining fair value. The

Corporation estimates the cash flows expected to be collected

using internal credit risk, interest rate and prepayment risk models

that incorporate the Corporation’s best estimate of current key

assumptions, such as default rates, loss severity and prepayment

speeds for the life of the loan. The carrying value of loans is

presented net of the applicable allowance for loan losses and

excludes leases. The Corporation elected to account for certain

commercial loans and residential mortgage loans under the fair

value option.

Deposits

The fair value for certain deposits with stated maturities was

determined by discounting contractual cash flows using current

market rates for instruments with similar maturities. The carrying

value of non-U.S. time deposits approximates fair value. For

deposits with no stated maturities, the carrying value was

considered to approximate fair value and does not take into

account the significant value of the cost advantage and stability

of the Corporation’s long-term relationships with depositors. The

Corporation accounts for certain long-term fixed-rate deposits

under the fair value option.

Long-term Debt

The Corporation uses quoted market prices, when available, to

estimate fair value for its long-term debt. When quoted market

prices are not available, fair value is estimated based on current

market interest rates and credit spreads for debt with similar terms

and maturities. The Corporation accounts for certain structured

liabilities under the fair value option.

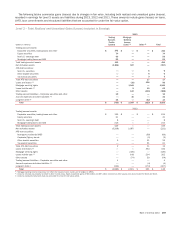

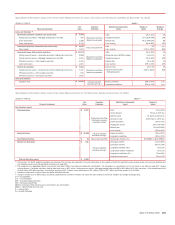

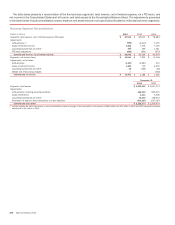

Fair Value of Financial Instruments

The carrying values and fair values by fair value hierarchy of certain

financial instruments where only a portion of the ending balance

was carried at fair value at December 31, 2013 and 2012 are

presented in the table below.

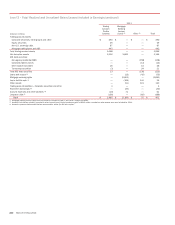

Fair Value of Financial Instruments

December 31, 2013

Fair Value

(Dollars in millions)

Carrying

Value Level 2 Level 3 Total

Financial assets

Loans $ 885,724 $ 102,564 $ 789,273 $ 891,837

Loans held-for-sale 11,362 8,872 2,613 11,485

Financial liabilities

Deposits 1,119,271 1,119,512 — 1,119,512

Long-term debt 249,674 257,402 1,990 259,392

December 31, 2012

Financial assets

Loans $ 859,875 $ 105,119 $ 772,761 $ 877,880

Loans held-for-sale 19,413 15,087 4,321 19,408

Financial liabilities

Deposits 1,105,261 1,105,669 — 1,105,669

Long-term debt 275,585 281,173 2,301 283,474

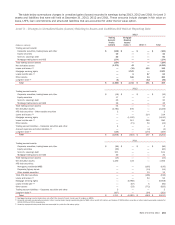

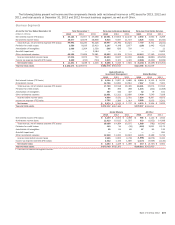

Commercial Unfunded Lending Commitments

Fair values were generally determined using a discounted cash

flow valuation approach which is applied using market-based CDS

or internally developed benchmark credit curves. The Corporation

accounts for certain loan commitments under the fair value option.

The carrying values and fair values of the Corporation’s

commercial unfunded lending commitments were $830 million and

$3.7 billion at December 31, 2013, and $1.0 billion and $4.5

billion at December 31, 2012. Commercial unfunded lending

commitments are primarily classified as Level 3. The carrying value

of these commitments is classified in accrued expenses and other

liabilities.

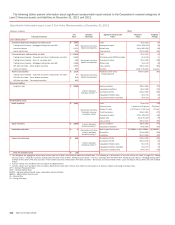

The Corporation does not estimate the fair values of consumer

unfunded lending commitments because, in many instances, the

Corporation can reduce or cancel these commitments by providing

notice to the borrower. For more information on commitments, see

Note 12 – Commitments and Contingencies.