Bank of America 2012 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2012 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.118 Bank of America 2012

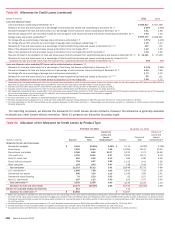

losses. Our process for determining the allowance for credit losses

is discussed in Note 1 – Summary of Significant Accounting

Principles to the Consolidated Financial Statements. We evaluate

our allowance at the portfolio segment level and our portfolio

segments are Home Loans, Credit Card and Other Consumer, and

Commercial. Due to the variability in the drivers of the assumptions

used in this process, estimates of the portfolio’s inherent risks

and overall collectability change with changes in the economy,

individual industries, countries, and borrowers’ ability and

willingness to repay their obligations. The degree to which any

particular assumption affects the allowance for credit losses

depends on the severity of the change and its relationship to the

other assumptions.

Key judgments used in determining the allowance for credit

losses include risk ratings for pools of commercial loans and

leases, market and collateral values and discount rates for

individually evaluated loans, product type classifications for

consumer and commercial loans and leases, loss rates used for

consumer and commercial loans and leases, adjustments made

to address current events and conditions, considerations

regarding domestic and global economic uncertainty, and overall

credit conditions.

Our estimate for the allowance for loan and lease losses is

sensitive to the loss rates and expected cash flows from our Home

Loans and Credit Card and Other Consumer portfolio segments,

as well as our U.S. small business commercial portfolio within the

Commercial portfolio segment. For each one percent increase in

the loss rates on loans collectively evaluated for impairment in

our Home Loans portfolio segment, excluding PCI loans, coupled

with a one percent decrease in the discounted cash flows on those

loans individually evaluated for impairment within this portfolio

segment, the allowance for loan and lease losses at December 31,

2012 would have increased by $147 million. PCI loans within our

Home Loans portfolio segment are initially recorded at fair value.

Applicable accounting guidance prohibits carry-over or creation of

valuation allowances in the initial accounting. However,

subsequent decreases in the expected cash flows from the date

of acquisition result in a charge to the provision for credit losses

and a corresponding increase to the allowance for loan and lease

losses. We subject our PCI portfolio to stress scenarios to evaluate

the potential impact given certain events. A one percent decrease

in the expected cash flows could result in a $208 million

impairment of the portfolio, of which $99 million would be related

to our discontinued real estate portfolio. For each one percent

increase in the loss rates on loans collectively evaluated for

impairment within our Credit Card and Other Consumer portfolio

segment and U.S. small business commercial portfolio coupled

with a one percent decrease in the expected cash flows on those

loans individually evaluated for impairment within the portfolio

segment and the U.S. small business commercial portfolio, the

allowance for loan and lease losses at December 31, 2012 would

have increased by $60 million.

Our allowance for loan and lease losses is sensitive to the risk

ratings assigned to loans and leases within the Commercial

portfolio segment (excluding the U.S. small business commercial

portfolio). Assuming a downgrade of one level in the internal risk

ratings for commercial loans and leases, except loans and leases

already risk-rated Doubtful as defined by regulatory authorities,

the allowance for loan and lease losses would have increased by

$2.2 billion at December 31, 2012.

The allowance for loan and lease losses as a percentage of

total loans and leases at December 31, 2012 was 2.69 percent

and these hypothetical increases in the allowance would raise the

ratio to 2.98 percent.

These sensitivity analyses do not represent management’s

expectations of the deterioration in risk ratings or the increases

in loss rates but are provided as hypothetical scenarios to assess

the sensitivity of the allowance for loan and lease losses to

changes in key inputs. We believe the risk ratings and loss

severities currently in use are appropriate and that the probability

of the alternative scenarios outlined above occurring within a short

period of time is remote.

The process of determining the level of the allowance for credit

losses requires a high degree of judgment. It is possible that

others, given the same information, may at any point in time reach

different reasonable conclusions.

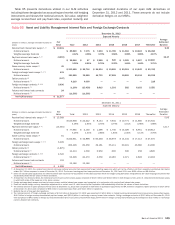

Mortgage Servicing Rights

MSRs are nonfinancial assets that are created when a mortgage

loan is sold and we retain the right to service the loan. We account

for consumer MSRs at fair value with changes in fair value recorded

in the Corporation’s Consolidated Statement of Income in

mortgage banking income (loss). Commercial and residential

reverse mortgage MSRs are accounted for using the amortization

method, lower of cost or market value, with impairment recognized

as a reduction of mortgage banking income (loss). At

December 31, 2012, our total MSR balance was $5.9 billion.

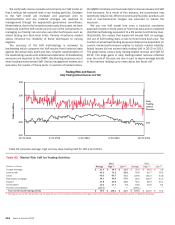

We determine the fair value of our consumer MSRs using a

valuation model that calculates the present value of estimated

future net servicing income. The model incorporates key economic

assumptions including estimates of prepayment rates and

resultant weighted-average lives of the MSRs, and the option-

adjusted spread levels. These variables can, and generally do,

change from quarter to quarter as market conditions and projected

interest rates change. These assumptions are subjective in nature

and changes in these assumptions could materially affect our

operating results. For example, decreasing the prepayment rate

assumption used in the valuation of our consumer MSRs by

10 percent while keeping all other assumptions unchanged could

have resulted in an estimated increase of $510 million in MSRs

and mortgage banking income (loss) at December 31, 2012. This

impact does not reflect any hedge strategies that may be

undertaken to mitigate such risk.

We manage potential changes in the fair value of MSRs through

a comprehensive risk management program. The intent is to

mitigate the effects of changes in the fair value of MSRs through

the use of risk management instruments. To reduce the sensitivity

of earnings to interest rate and market value fluctuations,

securities including MBS and U.S. Treasuries, as well as certain

derivatives such as options and interest rate swaps may be used

to hedge certain market risks of the MSRs, but are not designated

as accounting hedges. These instruments are carried at fair value

with changes in fair value recognized in mortgage banking income

(loss). For more information, see Mortgage Banking Risk

Management on page 116.

For additional information on MSRs, including the sensitivity of

weighted-average lives and the fair value of MSRs to changes in

modeled assumptions, see Note 24 – Mortgage Servicing Rights

to the Consolidated Financial Statements.