Bank of America 2012 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2012 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

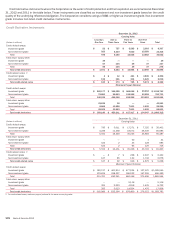

Bank of America 2012 171

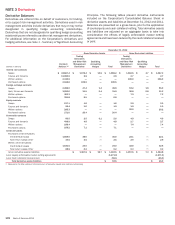

December 31, 2011

Gross Derivative Assets Gross Derivative Liabilities

(Dollars in billions)

Contract/

Notional (1)

Trading

Derivatives

and Other Risk

Management

Derivatives

Qualifying

Accounting

Hedges Total

Trading

Derivatives

and Other Risk

Management

Derivatives

Qualifying

Accounting

Hedges Total

Interest rate contracts

Swaps $ 40,473.7 $ 1,490.7 $ 15.9 $ 1,506.6 $ 1,473.0 $ 12.3 $ 1,485.3

Futures and forwards 12,105.8 2.9 0.2 3.1 3.4 — 3.4

Written options 2,534.0 — — — 117.8 — 117.8

Purchased options 2,467.2 120.0 — 120.0 — — —

Foreign exchange contracts

Swaps 2,381.6 48.3 2.6 50.9 58.9 2.2 61.1

Spot, futures and forwards 2,548.8 37.2 1.3 38.5 39.2 0.3 39.5

Written options 368.5 — — — 9.4 — 9.4

Purchased options 341.0 9.0 — 9.0 — — —

Equity contracts

Swaps 75.5 1.5 — 1.5 1.7 — 1.7

Futures and forwards 52.1 1.8 — 1.8 1.5 — 1.5

Written options 367.1 — — — 17.7 — 17.7

Purchased options 360.2 19.6 — 19.6 — — —

Commodity contracts

Swaps 73.8 4.9 0.1 5.0 5.9 — 5.9

Futures and forwards 470.5 5.3 — 5.3 3.2 — 3.2

Written options 142.3 — — — 9.5 — 9.5

Purchased options 141.3 9.5 — 9.5 — — —

Credit derivatives

Purchased credit derivatives:

Credit default swaps 1,944.8 95.8 — 95.8 13.8 — 13.8

Total return swaps/other 17.5 0.6 — 0.6 0.3 — 0.3

Written credit derivatives:

Credit default swaps 1,885.9 14.1 — 14.1 90.5 — 90.5

Total return swaps/other 17.8 0.5 — 0.5 0.7 — 0.7

Gross derivative assets/liabilities $ 1,861.7 $ 20.1 $ 1,881.8 $ 1,846.5 $ 14.8 $ 1,861.3

Less: Legally enforceable master netting agreements (1,749.9) (1,749.9)

Less: Cash collateral received/paid (58.9) (51.9)

Total derivative assets/liabilities $ 73.0 $ 59.5

(1) Represents the total contract/notional amount of derivative assets and liabilities outstanding.

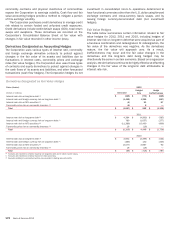

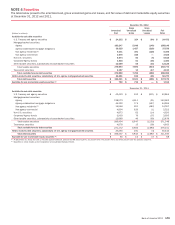

ALM and Risk Management Derivatives

The Corporation’s ALM and risk management activities include the

use of derivatives to mitigate risk to the Corporation including

derivatives designated in qualifying hedge accounting

relationships and derivatives used in other risk management

activities. Interest rate, foreign exchange, equity, commodity and

credit contracts are utilized in the Corporation’s ALM and risk

management activities.

The Corporation maintains an overall interest rate risk

management strategy that incorporates the use of interest rate

contracts, which are generally non-leveraged generic interest rate

and basis swaps, options, futures and forwards, to minimize

significant fluctuations in earnings that are caused by interest rate

volatility. The Corporation’s goal is to manage interest rate

sensitivity and volatility so that movements in interest rates do

not significantly adversely affect earnings or capital. As a result

of interest rate fluctuations, hedged fixed-rate assets and liabilities

appreciate or depreciate in fair value. Gains or losses on the

derivative instruments that are linked to the hedged fixed-rate

assets and liabilities are expected to substantially offset this

unrealized appreciation or depreciation.

Market risk, including interest rate risk, can be substantial in

the mortgage business. Market risk is the risk that values of

mortgage assets or revenues will be adversely affected by changes

in market conditions such as interest rate movements. To mitigate

the interest rate risk in mortgage banking production income, the

Corporation utilizes forward loan sale commitments and other

derivative instruments including purchased options and certain

debt securities. The Corporation also utilizes derivatives such as

interest rate options, interest rate swaps, forward settlement

contracts and Eurodollar futures to hedge certain market risks of

MSRs. For additional information on MSRs, see Note 24 – Mortgage

Servicing Rights.

The Corporation uses foreign exchange contracts to manage

the foreign exchange risk associated with certain foreign currency-

denominated assets and liabilities, as well as the Corporation’s

investments in non-U.S. subsidiaries. Foreign exchange contracts,

which include spot and forward contracts, represent agreements

to exchange the currency of one country for the currency of another

country at an agreed-upon price on an agreed-upon settlement

date. Exposure to loss on these contracts will increase or decrease

over their respective lives as currency exchange and interest rates

fluctuate.

The Corporation enters into derivative commodity contracts

such as futures, swaps, options and forwards as well as non-

derivative commodity contracts to provide price risk management

services to customers or to manage price risk associated with its

physical and financial commodity positions. The non-derivative