Bank of America 2011 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2011 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Bank of America 2011 191

NOTE 8 Securitizations and Other Variable

Interest Entities

The Corporation utilizes VIEs in the ordinary course of business

to support its own and its customers’ financing and investing

needs. The Corporation routinely securitizes loans and debt

securities using VIEs as a source of funding for the Corporation

and as a means of transferring the economic risk of the loans or

debt securities to third parties. The Corporation also administers,

structures or invests in other VIEs including CDOs, investment

vehicles and other entities.

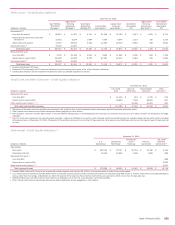

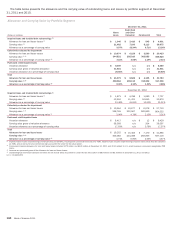

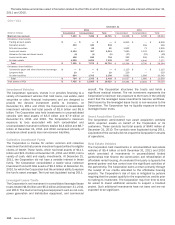

The following tables present the assets and liabilities of

consolidated and unconsolidated VIEs at December 31, 2011 and

2010, in situations where the Corporation has continuing

involvement with transferred assets or if the Corporation otherwise

has a variable interest in the VIE. The tables also present the

Corporation’s maximum exposure to loss at December 31, 2011

and 2010 resulting from its involvement with consolidated VIEs

and unconsolidated VIEs in which the Corporation holds a variable

interest. The Corporation’s maximum exposure to loss is based

on the unlikely event that all of the assets in the VIEs become

worthless and incorporates not only potential losses associated

with assets recorded on the Corporation’s Consolidated Balance

Sheet but also potential losses associated with off-balance sheet

commitments such as unfunded liquidity commitments and other

contractual arrangements. The Corporation’s maximum exposure

to loss does not include losses previously recognized through write-

downs of assets.

The Corporation invests in ABS issued by third-party VIEs with

which it has no other form of involvement. These securities are

included in Note 3 – Trading Account Assets and Liabilities and Note

5 – Securities. In addition, the Corporation uses VIEs such as trust

preferred securities trusts in connection with its funding activities

as described in Note 13 – Long-term Debt. The Corporation also

uses VIEs in the form of synthetic securitization vehicles to mitigate

a portion of the credit risk on its residential mortgage loan portfolio

as described in Note 6 – Outstanding Loans and Leases. The

Corporation uses VIEs, such as cash funds managed within Global

Wealth & Investment Management (GWIM), to provide investment

opportunities for clients. These VIEs, which are not consolidated

by the Corporation, are not included in the tables within this Note.

Except as described below, the Corporation did not provide

financial support to consolidated or unconsolidated VIEs during

2011 or 2010 that it was not previously contractually required to

provide, nor does it intend to do so.

Mortgage-related Securitizations

First-lien Mortgages

As part of its mortgage banking activities, the Corporation

securitizes a portion of the first-lien residential mortgage loans it

originates or purchases from third parties, generally in the form

of MBS guaranteed by government-sponsored enterprises, FNMA

and FHLMC (collectively the GSEs), or GNMA in the case of FHA-

insured and U.S. Department of Veteran Affairs (VA)-guaranteed

mortgage loans. Securitization usually occurs in conjunction with

or shortly after loan closing or purchase. In addition, the

Corporation may, from time to time, securitize commercial

mortgages it originates or purchases from other entities. The

Corporation typically services the loans it securitizes. Further, the

Corporation may retain beneficial interests in the securitization

trusts including senior and subordinate securities and equity

tranches issued by the trusts. Except as described below and in

Note 9 – Representations and Warranties Obligations and Corporate

Guarantees, the Corporation does not provide guarantees or

recourse to the securitization trusts other than standard

representations and warranties.

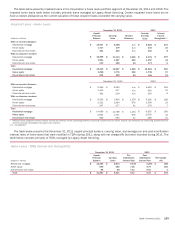

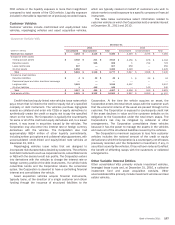

The table below summarizes select information related to first-

lien mortgage securitizations for 2011 and 2010.

First-lien Mortgage Securitizations

(Dollars in millions)

Cash proceeds from new securitizations (1)

Loss on securitizations, net of hedges (2)

Cash flows received on residual interests

Residential Mortgage

Agency

2011

$ 142,910

(373)

—

2010

$243,901

(473)

—

Non-Agency

Prime

2011

$—

—

3

2010

$—

—

18

Subprime

2011

$—

—

38

2010

$—

—

58

Alt-A

2011

$36

—

6

2010

$7

—

2

Commercial

Mortgage

2011

$ 4,468

—

18

2010

$ 4,227

—

20

(1) The Corporation sells residential mortgage loans to GSEs in the normal course of business and receives MBS in exchange which may then be sold into the market to third-party investors for cash

proceeds.

(2) Substantially all of the first-lien residential mortgage loans securitized are initially classified as LHFS and accounted for under the fair value option. As such, gains are recognized on these LHFS prior

to securitization. During 2011 and 2010, the Corporation recognized $2.9 billion and $5.1 billion of gains on these LHFS, net of hedges.

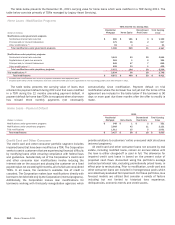

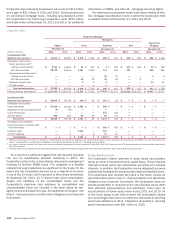

In addition to cash proceeds as reported in the table above,

the Corporation received securities with an initial fair value of $545

million and $23.7 billion in connection with first-lien mortgage

securitizations, principally residential agency securitizations, in

2011 and 2010. All of these securities were initially classified as

Level 2 assets within the fair value hierarchy. During 2011 and

2010, there were no changes to the initial classification.

The Corporation recognizes consumer MSRs from the sale or

securitization of first-lien mortgage loans. Servicing fee and

ancillary fee income on consumer mortgage loans serviced,

including securitizations where the Corporation has continuing

involvement, were $5.8 billion and $6.4 billion in 2011 and 2010.

Servicing advances on consumer mortgage loans, including

securitizations where the Corporation has continuing involvement,

were $26.0 billion and $24.3 billion at December 31, 2011 and

2010. The Corporation may have the option to repurchase

delinquent loans out of securitization trusts, which reduces the

amount of servicing advances it is required to make. During 2011

and 2010, $9.0 billion and $14.5 billion of loans were repurchased

from first-lien securitization trusts as a result of loan delinquencies

or in order to perform modifications. The majority of these loans

repurchased were FHA-insured mortgages collateralizing GNMA

securities. In addition, the Corporation has retained commercial

MSRs from the sale or securitization of commercial mortgage

loans. Servicing fee and ancillary fee income on commercial

mortgage loans serviced, including securitizations where the