Bank of America 2011 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2011 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Bank of America 2011 211

At December 31, 2011 and 2010, Bank of America Corporation

had approximately $69.8 billion and $88.4 billion of authorized,

but unissued corporate debt and other securities under its existing

U.S. shelf registration statements. At December 31, 2011 and

2010, Bank of America, N.A. had approximately $67.3 billion and

$53.3 billion of authorized, but unissued bank notes under its

existing $75 billion bank note program. Long-term bank notes

issued and outstanding under the program totaled $6.3 billion and

$7.1 billion at December 31, 2011 and 2010. At both

December 31, 2011 and 2010, Bank of America, N.A. had

approximately $20.6 billion of authorized, but unissued mortgage

notes under its $30.0 billion mortgage bond program.

The weighted-average effective interest rates for total long-term

debt (excluding senior structured notes), total fixed-rate debt and

total floating-rate debt, were 4.35 percent, 5.17 percent and 1.38

percent, respectively, at December 31, 2011 and 3.96 percent,

5.02 percent and 1.09 percent, respectively, at December 31,

2010. The Corporation’s ALM activities maintain an overall interest

rate risk management strategy that incorporates the use of

interest rate contracts to manage fluctuations in earnings that are

caused by interest rate volatility. The Corporation’s goal is to

manage interest rate sensitivity so that movements in interest

rates do not significantly adversely affect earnings and capital.

The above weighted-average rates are the contractual interest

rates on the debt and do not reflect the impacts of derivative

transactions.

The weighted-average interest rate for debt, excluding senior

structured notes, issued by Merrill Lynch & Co., Inc. and

subsidiaries was 4.74 percent and 4.11 percent at December 31,

2011 and 2010. As of December 31, 2011, the Corporation has

not assumed or guaranteed the $105.6 billion of long-term debt

that was issued or guaranteed by Merrill Lynch & Co., Inc. or its

subsidiaries prior to the acquisition of Merrill Lynch by the

Corporation. All existing Merrill Lynch & Co., Inc. guarantees of

securities issued by certain Merrill Lynch subsidiaries under

various non-U.S. securities offering programs will remain in full

force and effect as long as those securities are outstanding, and

the Corporation has not assumed any of those prior Merrill Lynch

& Co., Inc. guarantees or otherwise guaranteed such securities.

Certain senior structured notes are accounted for under the

fair value option. For more information on these senior structured

notes, see Note 23 – Fair Value Option.

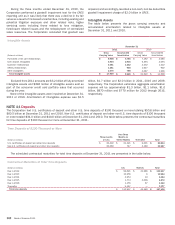

The table below represents the carrying value for aggregate

annual maturities of long-term debt at December 31, 2011.

Long-term Debt by Maturity

(Dollars in millions)

Bank of America Corporation

Merrill Lynch & Co., Inc. and subsidiaries

Bank of America, N.A. and other subsidiaries

Other debt

Total long-term debt excluding consolidated VIEs

Long-term debt of consolidated VIEs

Total long-term debt

2012

$ 43,877

22,494

5,776

13,738

85,885

11,530

$ 97,415

2013

$ 9,967

16,579

—

4,888

31,434

14,353

$ 45,787

2014

$ 19,166

17,784

29

1,658

38,637

9,201

$ 47,838

2015

$ 13,895

4,415

—

380

18,690

1,330

$ 20,020

2016

$ 20,575

3,897

1,134

15

25,621

2,898

$ 28,519

Thereafter

$ 73,940

38,954

7,928

2,122

122,944

9,742

$ 132,686

Total

$ 181,420

104,123

14,867

22,801

323,211

49,054

$ 372,265

Included in the above table are certain structured notes that

contain provisions whereby the borrowings are redeemable at the

option of the holder (put options) at specified dates prior to

maturity. Other structured notes have coupon or repayment terms

linked to the performance of debt or equity securities, indices,

currencies or commodities and the maturity may be accelerated

based on the value of a referenced index or security. In both cases,

the Corporation or a subsidiary may be required to settle the

obligation for cash or other securities prior to the contractual

maturity date. These borrowings are reflected in the above table

as maturing at their earliest put or redemption date.

Trust Preferred and Hybrid Securities

Trust preferred securities (Trust Securities) are primarily issued by

trust companies (the Trusts) that are not consolidated. These Trust

Securities are mandatorily redeemable preferred security

obligations of the Trusts. The sole assets of the Trusts generally

are junior subordinated deferrable interest notes of the

Corporation or its subsidiaries (the Notes). The Trusts generally

are 100 percent-owned finance subsidiaries of the Corporation.

Obligations associated with the Notes are included in the long-

term debt table on page 210.

Certain of the Trust Securities were issued at a discount and

may be redeemed prior to maturity at the option of the Corporation.

The Trusts generally have invested the proceeds of such Trust

Securities in the Notes. Each issue of the Notes has an interest

rate equal to the corresponding Trust Securities distribution rate.

The Corporation has the right to defer payment of interest on the

Notes at any time or from time to time for a period not exceeding

five years provided that no extension period may extend beyond

the stated maturity of the relevant Notes. During any such

extension period, distributions on the Trust Securities will also be

deferred and the Corporation’s ability to pay dividends on its

common and preferred stock will be restricted.

The Trust Securities generally are subject to mandatory

redemption upon repayment of the related Notes at their stated

maturity dates or their earlier redemption at a redemption price

equal to their liquidation amount plus accrued distributions to the

date fixed for redemption and the premium, if any, paid by the

Corporation upon concurrent repayment of the related Notes.

Periodic cash payments and payments upon liquidation or

redemption with respect to Trust Securities are guaranteed by the

Corporation or its subsidiaries to the extent of funds held by the

Trusts (the Preferred Securities Guarantee). The Preferred

Securities Guarantee, when taken together with the Corporation’s

other obligations including its obligations under the Notes,

generally will constitute a full and unconditional guarantee, on a

subordinated basis, by the Corporation of payments due on the

Trust Securities.

Hybrid Income Term Securities (HITS) totaling $1.6 billion were

issued by the Trusts to institutional investors during 2007. The

BAC Capital Trust XIII Floating-Rate Preferred HITS had a

distribution rate of three-month LIBOR plus 40 bps and the BAC

Capital Trust XIV Fixed-to-Floating Rate Preferred HITS had an initial

distribution rate of 5.63 percent. Both series of HITS represent