RBS 2009 Annual Report Download - page 259

Download and view the complete annual report

Please find page 259 of the 2009 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

257RBS Group Annual Report and Accounts 2009

Fair value is the amount for which an asset could be exchanged, or a

liability settled, between knowledgeable, willing parties in an arm’s

length transaction. Fair values are determined from quoted prices in

active markets for identical financial assets or financial liabilities where

these are available. Fair value for a net open position in a financial asset

or financial liability in an active market is the current bid or offer price

times the number of units of the instrument held. Where a trading

portfolio contains both financial assets and financial liabilities which are

derivatives of the same underlying instrument, fair value is determined

by valuing the gross long and short positions at current mid market

prices, with an adjustment at portfolio level to the net open long or short

position to amend the valuation to bid or offer as appropriate. Where the

market for a financial instrument is not active, fair value is established

using a valuation technique. These valuation techniques involve a

degree of estimation, the extent of which depends on the instrument’s

complexity and the availability of market-based data. More details about

the Group’s valuation methodologies and the sensitivity to reasonably

possible alternative assumptions of the fair value of financial

instruments valued using techniques where at least one significant input

is unobservable are given in Note 11 on pages 270 to 291.

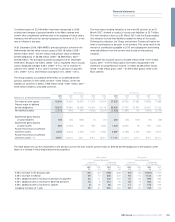

General insurance claims

The Group makes provision for the full cost of settling outstanding

claims arising from its general insurance business at the balance sheet

date, including claims estimated to have been incurred but not yet

reported at that date and claims handling expenses. General insurance

claims provisions amounted to £5,802 million at 31 December 2009

(2008 – £5,478 million; 2007 – £5,466 million).

Provisions are determined by management based on experience of

claims settled and on statistical models which require certain

assumptions to be made regarding the incidence, timing and amount of

claims and any specific factors such as adverse weather conditions. In

order to calculate the total provision required, the historical development

of claims is analysed using statistical methodology to extrapolate, within

acceptable probability parameters, the value of outstanding claims at

the balance sheet date. Also included in the estimation of outstanding

claims are other assumptions such as the inflationary factor used for

bodily injury claims which is based on historical trends and, therefore,

allows for some increase due to changes in common law and statute.

Costs for both direct and indirect claims handling expenses are also

included. Outward reinsurance recoveries are accounted for in the same

accounting period as the direct claims to which they relate. The

outstanding claims provision is based on information available to

management and the eventual outcome may vary from the original

assessment. Actual claims experience may differ from the historical

pattern on which the estimate is based and the cost of settling

individual claims may exceed that assumed.

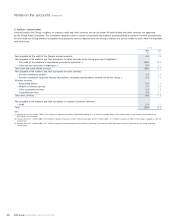

Goodwill

The Group capitalises goodwill arising on the acquisition of businesses,

as discussed in accounting policy 6. The carrying value of goodwill as

at 31 December 2009 was £14,264 million (2008 – £15,562 million; 2007

– £42,953 million).

Goodwill is the excess of the cost of an acquired business over the fair

value of its net assets. The determination of the fair value of assets and

liabilities of businesses acquired requires the exercise of management

judgement; for example those financial assets and liabilities for which

there are no quoted prices, and those non-financial assets where

valuations reflect estimates of market conditions, such as property.

Different fair values would result in changes to the goodwill arising and

to the post-acquisition performance of the acquisition. Goodwill is not

amortised but is tested for impairment annually or more frequently if

events or changes in circumstances indicate that it might be impaired.

For the purposes of impairment testing, goodwill acquired in a business

combination is allocated to each of the Group’s cash-generating units or

groups of cash-generating units expected to benefit from the

combination. Goodwill impairment testing involves the comparison of

the carrying value of a cash-generating unit or group of cash-

generating units with its recoverable amount. The recoverable amount is

the higher of the unit’s fair value and its value in use. Value in use is the

present value of expected future cash flows from the cash-generating

unit or group of cash-generating units. Fair value is the amount

obtainable for the sale of the cash-generating unit in an arm’s length

transaction between knowledgeable, willing parties.

Impairment testing inherently involves a number of judgmental areas:

the preparation of cash flow forecasts for periods that are beyond the

normal requirements of management reporting; the assessment of the

discount rate appropriate to the business; estimation of the fair value of

cash-generating units; and the valuation of the separable assets of

each business whose goodwill is being reviewed. Sensitivity to changes

in assumptions is discussed in Note 17 on page 303.

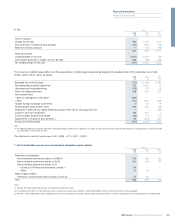

Deferred tax

The Group makes provision for deferred tax on short-term and other

temporary differences where tax recognition occurs at a different time

from accounting recognition. Deferred tax assets of £7,039 million were

recognised as at 31 December 2009 (2008 – £7,082 million; 2007 –

£3,119 million).

The Group has recognised deferred tax assets in respect of losses,

principally in the UK, and short-term timing differences. Deferred tax

assets are recognised in respect of unused tax losses to the extent that

it is probable that there will be future taxable profits against which the

losses can be utilised. Business projections prepared for impairment

reviews (see Note 17) indicate that sufficient future taxable income will

be available against which to offset these recognised deferred tax

assets within eight years. The number of years into the future for which

forecast profits should be considered when assessing the recoverability

of a deferred tax asset is a matter of judgment. A period of eight years

is underpinned by the Group’s business projections, its history of

profitable operation and the continuing strength of its core business

franchises. The Group’s cumulative losses are principally attributable to

the recent unparalleled market conditions. Deferred tax assets of £2,163

million (2008 – £1,748 million; 2007 – £687 million) have not been

recognised in respect of tax losses carried forward in jurisdictions

where doubt exists over the availability of future taxable profits.

Financial statements