RBS 2009 Annual Report Download - page 274

Download and view the complete annual report

Please find page 274 of the 2009 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390

|

|

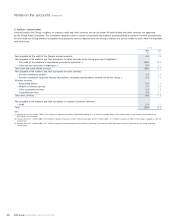

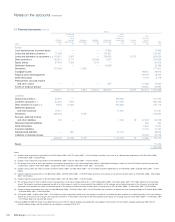

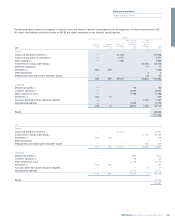

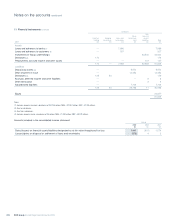

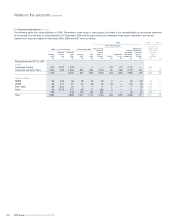

Notes on the accounts continued

RBS Group Annual Report and Accounts 2009272

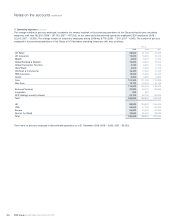

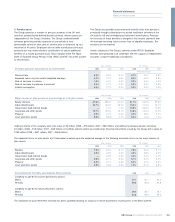

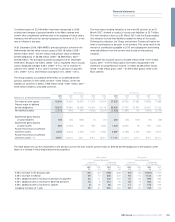

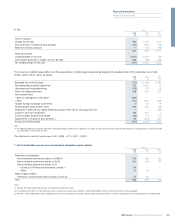

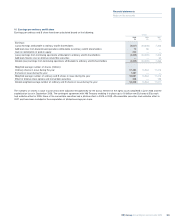

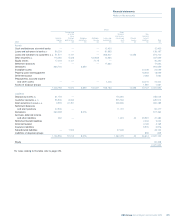

11 Financial instruments continued

Group

Designated Other

as at fair financial Non

value instruments financial

Held-for- through Hedging Available- Loans and (amortised Finance assets/

trading profit or loss derivatives for-sale receivables cost) leases liabilities Total

2007 £m £m £m £m £m £m £m £m £m

Assets

Cash and balances at central banks — — — 17,866 17,866

Loans and advances to banks (1) 71,639 — — 147,821 219,460

Loans and advances to customers (2, 3) 103,811 3,067 — 709,090 12,570 828,538

Debt securities (4) 190,671 5,777 95,536 2,672 294,656

Equity shares 37,546 7,866 7,614 — 53,026

Settlement balances — — — 16,589 16,589

Derivatives 274,849 2,553 277,402

Intangible assets 49,916 49,916

Property, plant and equipment 18,745 18,745

Deferred taxation 3,119 3,119

Prepayments, accrued income

and other assets — — — 877 14,785 15,662

Assets of disposal groups 45,850 45,850

678,516 16,710 2,553 103,150 894,915 12,570 132,415 1,840,829

Liabilities

Deposits by banks (5) 65,491 — 246,803 312,294

Customer accounts (6, 7) 60,426 7,505 614,432 682,363

Debt securities in issue (8, 9) 9,455 41,834 222,883 274,172

Settlement balances

and short positions 73,501 — 17,520 91,021

Derivatives 269,343 2,709 272,052

Accruals, deferred income

and other liabilities 209 — 1,545 19 32,435 34,208

Retirement benefit liabilities 460 460

Deferred taxation 5,400 5,400

Insurance liabilities 10,162 10,162

Subordinated liabilities — 897 37,146 38,043

Liabilities of disposal groups 29,228 29,228

478,425 50,236 2,709 1,140,329 19 77,685 1,749,403

Equity 91,426

1,840,829

Notes:

(1) Includes reverse repurchase agreements of £35,097 million (2008 – £58,771 million; 2007 – £175,941 million) and items in the course of collection from other banks of £2,533 million (2008 –

£2,888 million; 2007 – £3,095 million).

(2) Includes reverse repurchase agreements of £41,040 million (2008 – £39,313 million; 2007 – £142,357 million).

(3) The change in fair value of loans and advances to customers designated as at fair value through profit and loss attributable to changes in credit risk was £157 million income for the year and

cumulatively a credit of £140 million (2008 – charge £328 million; cumulative £440 million credit; 2007 – not material).

(4) Includes treasury bills and similar securities of £45,617 million (2008 – £31,509 million; 2007 – £16,315 million) and other eligible bills of £34,794 million (2008 – £25,028 million; 2007 – £1,914

million).

(5) Includes repurchase agreements of £38,006 million (2008 – £83,666 million; 2007 – £163,038 million) and items in the course of transmission to other banks of £770 million (2008 – £542 million;

2007 – £372 million).

(6) Includes repurchase agreements of £68,353 million (2008 – £58,143 million; 2007 – £134,916 million).

(7) The carrying amount of other customer accounts designated as at fair value through profit or loss is £101 million higher (2008 – £47 million lower; 2007 – £77 million higher) than the principal

amount. No amounts have been recognised in profit or loss for changes in credit risk associated with these liabilities as the changes are immaterial measured as the change in fair value from

movements in the period in the credit risk premium payable. The amounts include investment contracts with a carrying value of £5,170 million (2008 – £5,364 million; 2007 – £5,555 million).

(8) Comprises bonds and medium term notes of £164,900 million (2008 – £156,841 million; 2007 – £119,578 million) and certificates of deposit and other commercial paper of £102,668 million (2008

– £143,448 million; 2007 – £154,594 million).

(9) £155 million (2008 – £1,054 million; 2007 – £162 million) has been recognised in profit or loss for changes in credit risk associated with debt securities in issue designated as at fair value through

profit or loss measured as the change in fair value from movements in the period in the credit risk premium payable by the Group. The carrying amount is £810 million (2008 – £1,145 million; 2007

– £317 million) lower than the principal amount.

(10) During 2009 and 2008 the Group reclassified financial assets from the held-for-trading and available-for-sale categories into the loans and receivables category and during 2008 from the

held-for-trading category into the available-for-sale category (see pages 275 to 277).