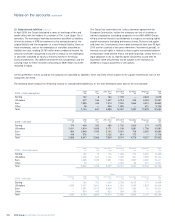

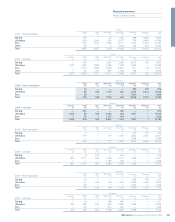

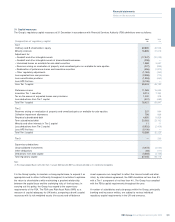

RBS 2009 Annual Report Download - page 323

Download and view the complete annual report

Please find page 323 of the 2009 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

321RBS Group Annual Report and Accounts 2009

Financial statements

Notes on the accounts

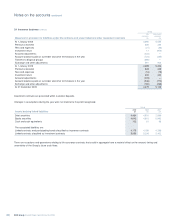

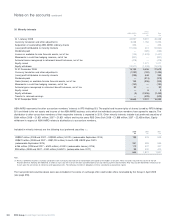

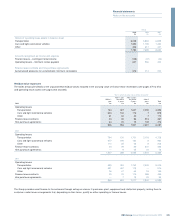

Dated loan capital continued

2009 2008 2007

£m £m £m

Other minority interest subordinated issues 12 16 16

ABN AMRO and subsidiaries

113 million 7.50% subordinated notes 2008 ——83

182 million 6.00% fixed rate subordinated notes 2009 (redeemed April 2009) — 169 132

182 million 6.13% fixed rate subordinated notes 2009 (redeemed June 2009) — 165 127

1,150 million 4.63% fixed rate subordinated notes 2009 (redeemed May 2009) — 1,104 848

250 million 4.70% CMS linked subordinated notes 2019 189 195 131

800 million 6.25% fixed rate subordinated notes 2010 733 795 598

100 million 5.13% flip flop Bermudan callable subordinated notes 2017 (callable December 2012) 84 89 75

500 million floating rate Bermudan callable subordinated lower tier 2 notes 2018 (callable May 2013) 426 455 350

1,000 million floating rate Bermudan callable subordinated lower tier 2 notes 2016 (callable September 2011) 862 923 710

13 million zero coupon subordinated notes 2029 (callable June 2010) 4 82

82 million floating rate subordinated notes 2017 68 72 55

103 million floating rate subordinated lower tier 2 notes 2020 83 89 68

170 million floating rate sinkable subordinated notes 2041 190 205 184

15 million CMS linked floating rate subordinated lower tier 2 notes 2020 10 10 11

1,500 million floating rate Bermudan callable subordinated lower tier 2 notes 2015 (callable June 2010) 1,326 1,419 1,087

5 million floating rate Bermudan callable subordinated lower tier 2 notes 2015 (callable October 2010) 4 54

65 million floating rate Bermudan callable subordinated lower tier 2 notes 2015 (callable October 2010) 58 62 48

US$12 million floating rate subordinated notes 2008 — —6

US$12 million floating rate subordinated notes 2008 — —6

US$165 million 6.14% subordinated notes 2019 132 152 94

US$72 million 5.98% subordinated notes 2019 34 49 7

US$500 million 4.65% subordinated notes 2018 293 359 214

US$500 million floating rate Bermudan callable subordinated notes 2013 — — 232

US$1,500 million floating rate Bermudan callable subordinated notes 2015 (callable March 2010) 887 982 717

US$100 million floating rate Bermudan callable subordinated lower tier 2 notes 2015 (callable October 2010) 62 68 50

US$36 million floating rate Bermudan callable subordinated lower tier 2 notes 2015 (callable October 2010) 22 25 18

US$1,000 million floating rate Bermudan callable subordinated lower tier 2 notes 2017 (callable January 2012) 598 661 479

AUD575 million 6.50% Bermudan callable subordinated lower tier 2 notes 2018 (callable May 2013) 318 286 231

AUD175 million 7.46% Bermudan callable subordinated lower tier 2 notes 2018 (callable May 2013) 93 79 73

26 million 7.42% subordinated notes 2016 27 28 20

7 million 7.38% subordinated notes 2016 786

256 million 5.25% fixed rate subordinated notes 2008 — — 190

13 million floating rate subordinated notes 2008 ——9

£42 million 8.18% subordinated notes 2010 715 19

£25 million 9.18% amortising MTN subordinated lower tier 2 notes 2011 8 915

£750 million 5% fixed rate Bermudan callable subordinated upper tier 2 notes 2016 727 728 642

US$250 million 7.75% fixed rate subordinated notes 2023 155 173 127

US$150 million 7.13% fixed rate subordinated notes 2093 93 104 76

US$250 million 7.00% fixed rate subordinated notes 2008 — — 127

US$68 million floating rate subordinated notes 2009 (6) ——34

US$12 million floating rate subordinated notes 2009 (6) ——6

BRL50 million floating rate subordinated notes 2013 (6) ——14

BRL250 million floating rate subordinated notes 2013 (6) ——71

BRL250 million floating rate subordinated notes 2014 (6) ——71

BRL885 million floating rate subordinated notes 2014 (6) —— 251

BRL300 million floating rate subordinated notes 2014 (6) ——85

PKR0.80 million floating rate subordinated notes 2012 — 76

MYR200 million zero coupon subordinated notes 2017 36 40 30

TRY60 million floating rate callable subordinated notes 2012 (redeemed September 2009) — 34 25

24,597 30,162 23,065

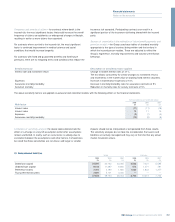

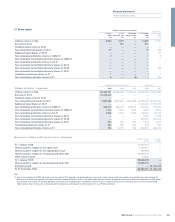

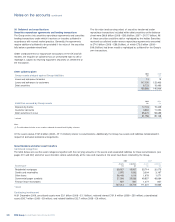

* In addition, the company has in issue 166 million (2008 and 2007 – 500 million) subordinated loan notes of 1,000 each, US$827 million (2008 and 2007 – US$1,950 million) subordinated loan

notes of US$1,000 each and £93 million (2008 and 2007 – £400 million) subordinated loan notes of £1,000 each. These loan notes are included in the company balance sheet as loan capital but are

reclassified as minority interest trust preferred securities on consolidation (see Note 26).

Notes:

(1) On-lent to The Royal Bank of Scotland plc on a subordinated basis.

(2) Unconditionally guaranteed by the company.

(3) In the event of certain changes in tax laws, dated loan capital issues may be redeemed in whole, but not in part, at the option of the issuer, at the principal amount thereof plus accrued interest,

subject to prior regulatory approval.

(4) Except as stated above, claims in respect of the Group’s dated loan capital are subordinated to the claims of other creditors. None of the Group’s dated loan capital is secured.

(5) Interest on all floating rate subordinated notes is calculated by reference to market rates.

(6) Transferred to Banco Santander.