RBS 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424 -

425

425 -

426

426 -

427

427 -

428

428 -

429

429 -

430

430 -

431

431 -

432

432 -

433

433 -

434

434 -

435

435 -

436

436 -

437

437 -

438

438 -

439

439 -

440

440 -

441

441 -

442

442 -

443

443 -

444

444 -

445

445

|

|

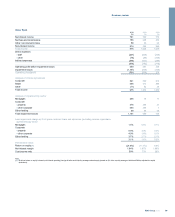

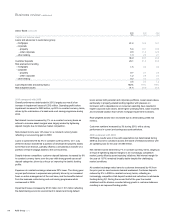

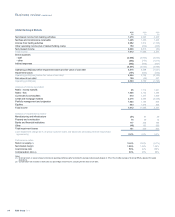

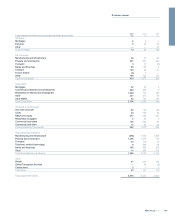

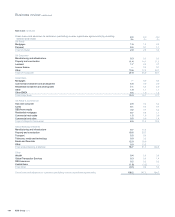

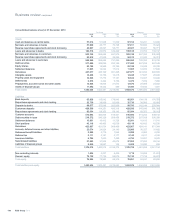

RBS Insurance continued

2010 2009 2008

Performance ratios

Return on equity (3) (7.9%) 1.7% 18.3%

Loss ratio (4) 92% 84% 70%

Commission ratio (5) 10% 9% 10%

Expense ratio (6) 13% 14% 14%

Combined operating ratio (7) 115% 106% 94%

Balance sheet

General insurance reserves - total (£m) 7,559 7,030 6,673

Notes:

(1) Other is predominantly made up of the discontinued personal lines broker business.

(2) Total in-force policies include travel and creditor policies sold through RBS Group. These comprise travel policies included in bank accounts e.g. Royalties Gold Account, and creditor policies sold

with bank products including mortgage, loan and card repayment payment protection.

(3) Divisional return on equity is based on divisional operating (loss)/profit after tax, divided by divisional average notional equity (based on regulatory capital).

(4) Loss ratio is based on net claims divided by net premium income for the UK businesses.

(5) Commission ratio is based on fees and commissions divided by gross written premium income for the UK businesses.

(6) Expense ratio is based on expenses (excluding fees and commissions) divided by gross written premium income for the UK businesses.

(7) Combined operating ratio is expenses (including fees and commissions) divided by gross written premium income, added to the loss ratio, for the UK businesses.

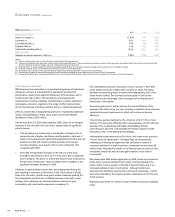

2010 compared with 2009

RBS Insurance has embarked on a significant programme of investment

designed to achieve a substantial lift in operational and financial

performance, ahead of the planned divestment of the business, with a

current target date of 2012. This programme encompasses the

enhancement of pricing capability, transformation of claims operations

and expense reduction, together with a range of other improvements

across the business, including a greater focus on capital management.

2010 as a whole was a disappointing profit year, impacted by significant

reserve strengthening for bodily injury claims and severe weather,

resulting in a loss of £295 million.

Income was down 2% (£63 million) against 2009, driven by a managed

reduction in the risk of the UK motor book, largely offset by significant

price increases:

xThis de-risking was achieved by a combination of rating action to

reduce the mix of higher-risk drivers, and the partial or total exit of

higher risk business lines (significantly scaling back the fleet and taxi

business and the exit of personal lines business sold through

insurance brokers). As a result in-force motor policies fell 14%

compared with 2009.

xEven with the significant reduction in the risk mix of the book,

average motor premiums were up 7% in the year, due to significant

price increases. The prices of like-for-like policies have increased by

35-40% over the last year. These increases were in addition to the

significant increases achieved in 2009.

Initiatives to grow ancillary income were also implemented during the

year resulting in revenues of £46 million in 2010 (£25 million in 2009).

Away from UK motor, overall home gross written premiums grew by 2%.

This included the exit from less profitable business in line with overall

strategy. Our underlying own brands business continues to grow

successfully, with gross written premiums increasing 4%.

The International business continued to invest in growth in 2010 with

gross written premiums of £425 million up 20% on 2009. The Italian

business successfully grew to a market share approaching 30% of the

direct insurer market. The German business grew 7% and is well

positioned to take advantage of the emerging shift to direct/internet

distribution in that market.

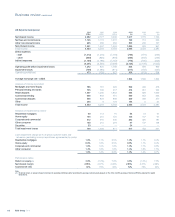

Several programmes to further improve the overall efficiency of the

business took effect during the year, including a reduction of six sites and

operational process improvements, which will continue to improve

efficiency.

Total in-force policies declined by 3%, driven by a fall of 14% in motor

policies. This was partly offset by higher travel policies, up 64% with new

business from a partnership with Nationwide Building Society

commencing in Q4 2010. The personal lines broker segment overall

declined by 43%, in line with business strategy.

Underwriting income declined by £63 million, with lower motor premium

income, driven by rating action. Increased fees and commissions

reflected profit sharing arrangements with UK Retail in relation to

insurance distribution to bank customers. Investment income was £28

million lower, reflecting the impact of low interest rates on returns on the

investment portfolio as well as lower gains realised on the sale of

investments.

Net claims were £326 million higher than in 2009, driven by increases to

bodily injury reserves relating to prior years, including allowance for

higher claims costs in respect of Periodic Payment Orders due to an

increased settlement rate of such claims. Although bodily injury

frequency has stabilised, severity has continued to deteriorate. Claims

were also impacted by the adverse weather experienced in the first and

fourth quarters.

Expenses were down 7%, driven by lower industry levies and marketing

costs.

RBS Group 201098

Business review continued