RBS 2010 Annual Report Download - page 62

Download and view the complete annual report

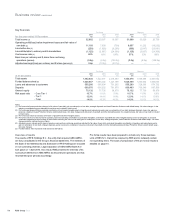

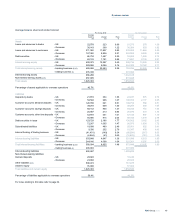

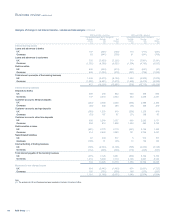

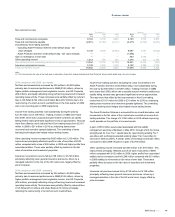

Please find page 62 of the 2010 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2009 compared with 2008 - pro forma

Operating loss

Group operating loss, excluding fair value of own debt, amortisation of

purchased intangible assets, write-down of goodwill and other intangible

assets, integration and restructuring costs, gain on redemption of own

debt, strategic disposals, gains on pensions curtailment and bonus tax

was £6,090 million, compared with a loss of £8,170 million in 2008. The

reduction in the loss is primarily a result of a substantial increase in non-

interest income partially offset by a significant increase in impairment

losses and lower net interest income.

After fair value of own debt, amortisation of purchased intangible assets,

write-down of goodwill and other intangible assets, integration and

restructuring costs, gain on redemption of own debt, strategic disposals,

gains on pensions curtailment and bonus tax, the Group recorded a loss

before tax of £2,291 million, compared with a loss before tax of £25,207

million in 2008.

After tax, non-controlling interests and preference share and other

dividends, the loss attributable to ordinary and B shareholders was

£3,607 million, compared with an attributable loss of £24,306 million in

2008.

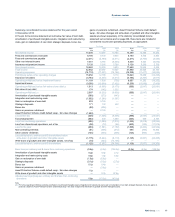

Total income

Total income, excluding the gain on redemption of own debt and strategic

disposals, increased by 53% to £29,567 million, primarily reflecting a

significant reduction in credit and other market losses. Increased market

volatility and strong customer demand in a positive trading environment

also contributed to this improvement. While income was down marginally

in UK Corporate and held steady in Retail & Commercial and RBS

Insurance, a significant improvement occurred in Global Banking &

Markets, reflecting the reduced credit and other market losses and a

more buoyant trading market during the year compared with 2008.

Net interest income

Net interest income fell by 14% to £13,567 million, with average loans

and advances to customers down 4% and average customer deposits

down 7%. Group net interest margin fell from 2.08% to 1.76% largely

reflecting the pressure on liability margins, given rates on many deposit

products already at floors in the low interest rate environment, and strong

competition, particularly for longer-term deposits and the build up of the

Group's liquidity portfolio.

Non-interest income

Non-interest income increased to £16,000 million from £3,603 million in

2008, largely reflecting the sharp improvement in income from trading

activities, as improved asset valuations led to lower credit market losses

and GBM benefited from the restructuring of its business to focus on core

customer franchises. However, fees and commissions fell as a result of

the withdrawal of the single premium payment protection insurance

product and the restructuring of UK current account overdraft fees.

Operating expenses

Total operating expenses, excluding amortisation of purchased intangible

assets, write-down of goodwill and other intangible assets, integration

and restructuring costs, gains on pensions curtailment and bonus tax,

increased by 7% to £17,401 million, largely resulting from increased staff

costs. Staff costs were up 14% with most of the movement relating to

adverse movements in foreign exchange rates and some salary inflation.

Changes in incentive compensation, primarily in Global Banking &

Markets, represented most of the remaining change. The Group

cost:income ratio improved to 69%, compared with 105% in 2008.

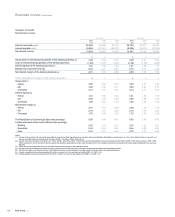

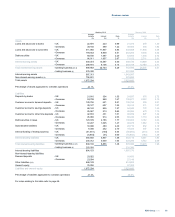

Impairment losses

Impairment losses increased to £13,899 million from £7,432 million in

2008, with Core bank impairments rising by £2,182 million and Non-Core

by £4,285 million. Signs that impairments might be plateauing appear to

have been borne out in the latter part of the year, and there are

indications that the pace of downwards credit rating migration for

corporates is slowing. Nonetheless, the financial circumstances of many

consumers and businesses remain fragile, and rising refinancing costs,

whether as a result of monetary tightening or of increased regulatory

capital requirements, could expose some customers to further difficulty.

Impairments represented 2.3% of gross loans and advances, excluding

reverse repos, in 2009 compared with 0.9% in 2008.

Risk elements in lending and potential problem loans at 31 December

2009 represented 6.2% of loans and advances, excluding reverse repos,

compared with 2.7% a year earlier. Provision coverage was 43%,

compared with 50% at 31 December 2008 as a consequence of the

growth in risk elements in lending being concentrated in secured,

property-related loans. These loans require relatively lower provisions in

view of their collateralised nature.

Non-operating items

Integration and restructuring costs decreased, primarily as ABN AMRO

integration activity neared completion, partly offset by restructuring

activity following the conclusion of the strategic review.

In 2009 the Group recorded a gain of £3,790 million on a liability

management exercise to redeem a number of Tier 1 and upper Tier 2

securities. In addition, the overall gain on strategic disposals, £132

million, primarily relates to gains on the sale of Bank of China and Linea

Directa partially offset by losses arising from the sale of the Retail and

Commercial Asian businesses and Latin America asset portfolio.

Pension curtailment gains of £2,148 million were recognised during the

fourth quarter of 2009 arising from changes to prospective pension

benefits in the defined benefit scheme and certain other subsidiary

schemes. A charge related to the UK Government's bonus tax proposals

of £208 million was reflected in 2009 with a further £160 million deferred

until 2010 and 2011.

Tax

The Group recorded a tax credit of £339 million in 2009, compared with a

tax credit of £1,280 million in 2008.

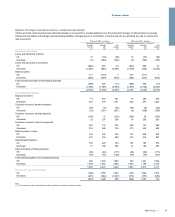

Earnings

Basic loss per ordinary and B share from continuing operations improved

from 146.2p to a loss of 6.3p. Adjusted loss per ordinary and B share

improved from 43.1p to a loss of 13.2p per share. The number of ordinary

shares in issue increased to 56,366 million at 31 December 2009,

compared with 39,456 million in issue at 31 December 2008, reflecting

the placing and open offer in April 2009. The Group also issued 51 billion

Bshares to Her Majesty's Treasury in December 2009.

RBS Group 201060

Business review continued